Recent ATO guidelines: Section 100A and Family Trust Distributions

Applications of Section 100A (S.100A)

Connected present entitlement

Benefit to another party

Tax reduction purpose

Significantly, S.100A is not confined to specific trust types; it applies broadly to trusts, including discretionary trusts, fixed trusts, and unit trusts. The distinction lies in the election of a ‘family trust,’ which involves a trust controlled by a ‘family group’ and is a subject unto itself.

Section 100A exemptions in family trusts

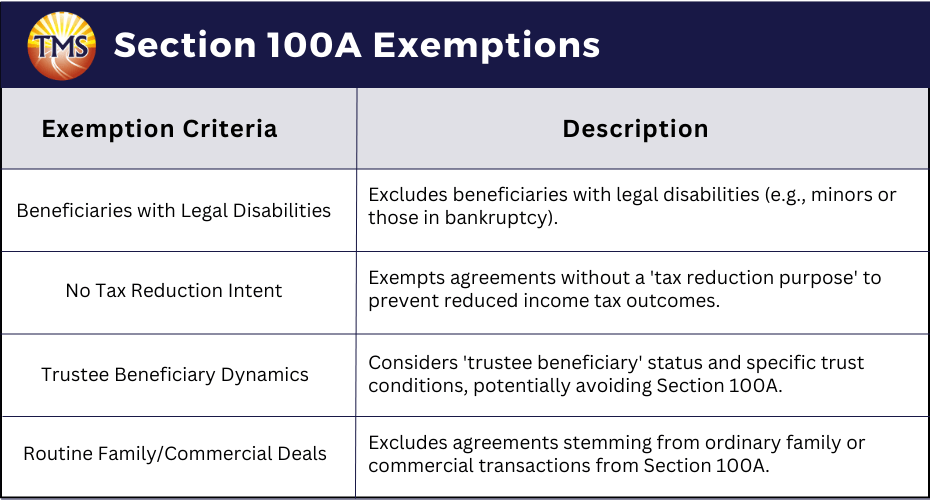

Section 100A presents notable exceptions, especially concerning family trust distribution tax and structures. It is important to recognise that certain criteria can prevent Section 100A from coming into play, allowing distributions to proceed without invoking this provision. These exceptions are pivotal for family trusts as they strive to protect assets, optimise tax efficiency, and maintain compliance.

These substantial exclusions include specific scenarios:

Beneficiaries with legal disabilities

Absence of tax reduction intent

Trustee beneficiary dynamics

Ordinary family or commercial transactions

Section 100A(13) excludes agreements arising from ‘routine family or commercial dealings.’ In such cases, the section remains inactive, acknowledging standard practices.

These exceptions empower family trusts to navigate tax complexities while safeguarding family interests, effectively managing assets, and minimising tax obligations within legal bounds.

Implications of the application of S.100A to a distribution

- The beneficiary is retroactively considered to have never possessed a current entitlement to the trust income.

- If the beneficiary’s entitlement was predicated on income receipt or allocation, that income is treated as though it was never disbursed or assigned.

The Australian Taxation Office (ATO) has the authority to retroactively invalidate trust distributions under Section 100A. Nevertheless, affected beneficiaries have the option to adjust their tax returns to recover previously paid taxes. These consequences are applicable universally, regardless of the existence of a default beneficiary clause in the trust deed or the nature of the trust income generated.

Section 100A can also have an impact on capital gains or franked dividends allocated to beneficiaries, potentially necessitating a reallocation of income. In such cases, the trustee may face additional assessments under Section 99A.

While Section 100A has implications for tax matters, it does not nullify trust distributions in terms of trust law. This distinction can give rise to legal and practical challenges, including complexities in accounting, for both the trust and its beneficiaries.

For example, a family member beneficiary has already received a trust distribution and tax has been remitted. If the ATO subsequently deems the distribution invalid, the trustee is generally liable for tax at the highest rate on the beneficiary’s share of income. While beneficiaries can pursue tax refunds, trust law often does not compel them to return received amounts. This raises questions about managing the trustee’s tax liability and the dynamics of family trust operations.

Finalised Australian Taxation Office (ATO) compliance guidelines

The Australian Taxation Office (ATO) introduced PCG 2022/D1 on 23 February 2022, outlining its initial strategy for Section 100A compliance in family trusts and businesses. These initial guidelines sparked controversy and criticism due to their content.

A few months later, on 8 December 2022, following extensive consultations over several months, the ATO unveiled the final Section 100A compliance guidelines, along with a compendium addressing feedback from the initial guidelines.

PCG 2022/2 is an improvement over PCG 2022/D1, including additional exempted scenarios from ATO compliance scrutiny under Section 100A. However, as we’ll discuss shortly, certain concerns remain for trustees, particularly regarding trust distributions involving adult children of discretionary trust controllers. This underscores the need for tax-efficient trust structures, benefiting future generations and safeguarding family assets while optimising tax in family trust distributions.

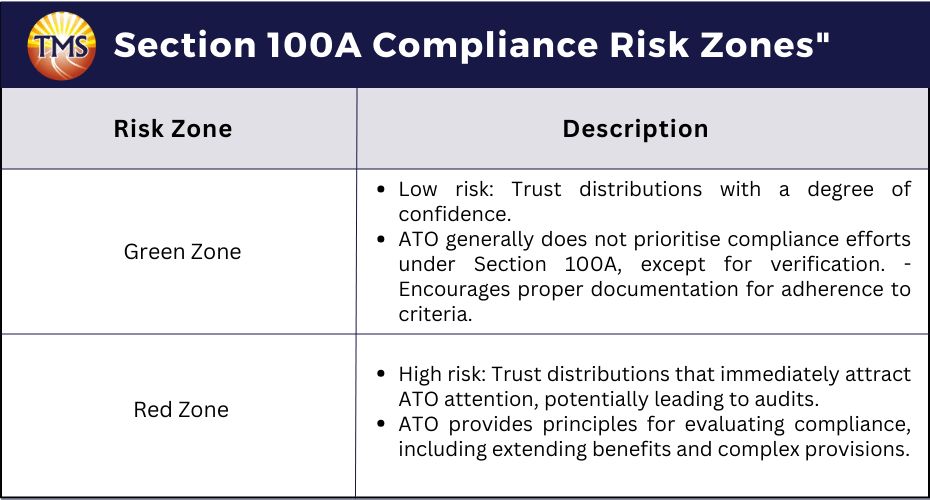

The ATO’s S.100A Compliance Guidelines provide a structured approach, focusing on trust distributions in family trusts and businesses. They help taxpayers assess the “S.100A risk” associated with their trust distributions.

The ATO employs a defined risk framework to categorise trust distributions based on their risk profiles, as outlined below.

Green zone = Low risk

Within the low-risk “green zone,” trust distributions come with a degree of confidence. The ATO typically does not prioritise compliance efforts related to these distributions under Section 100A, except to verify that they align with the taxpayer’s unique situation. Trustees are encouraged to maintain proper documentation to demonstrate their adherence to the criteria associated with the green zone.

Red zone = High risk

- Extending benefits to individuals beyond the current beneficiary, especially in cases involving an adult child.

- Involving complex or contrived provisions, such as commercial dealing.

- Offering opportunities for more direct benefit provision to as many beneficiaries as possible.

- Resulting in significantly reduced tax payments compared to more straightforward methods, potentially affecting the trust’s assessable income and the tax rate applied to the trust’s beneficiaries.

Trust arrangements situated outside the green or red zones are not automatically classified as high-risk for Section 100A. The ATO may engage with taxpayers to understand these arrangements, assess Section 100A applicability, and promote documentation for potential exemptions. Alternatively, trustees can explore adjustments to align their arrangements with the criteria of the green zone.

Importantly, these guidelines encompass considerations related to family trusts, family members, and businesses, taking into account potential tax advantages and underscoring the significance of tax-efficient trust structures. They have both retroactive and prospective applicability. Additionally, transitional relief provisions apply to trust distribution arrangements involving income years ending before July 1, 2014 (the “WHITE zone”), with partial relief available for trust distributions made before July 1, 2022.

These guidelines serve as a valuable resource for understanding the ATO’s approach to Section 100A compliance within the realm of discretionary trusts, ensuring effective management of trust distributions, optimising the tax landscape, and considering the implications for Australian residents and the trust’s beneficiaries.

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

need expert guidance on section 100a

experienced professionals can help you.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.