What exactly are fully franked dividends?

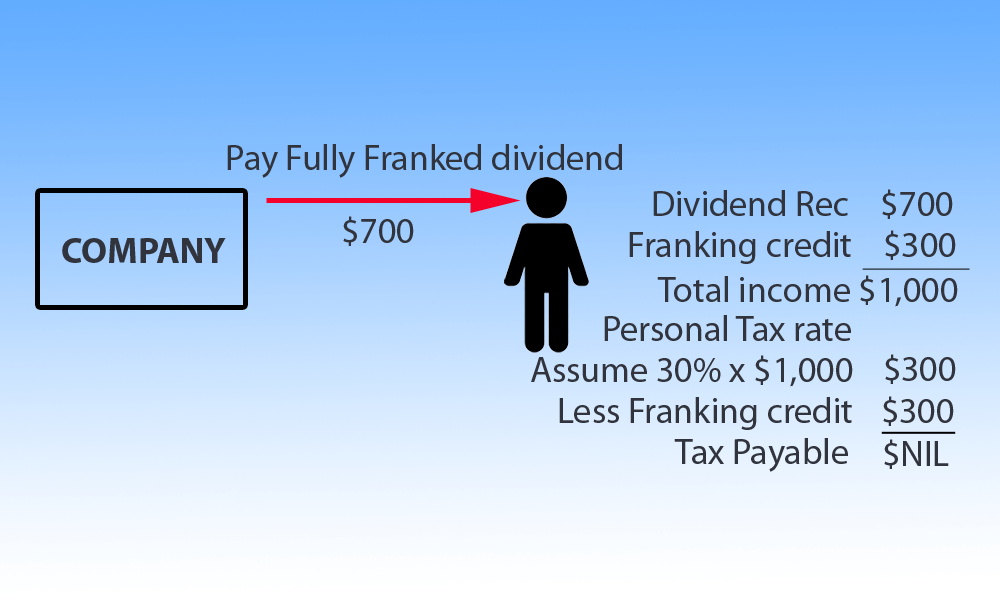

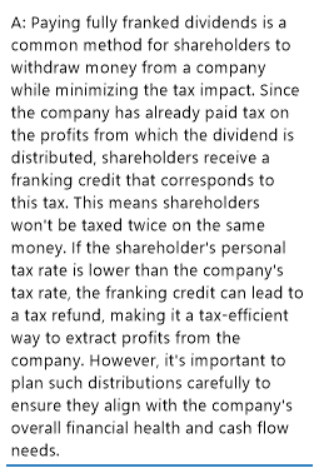

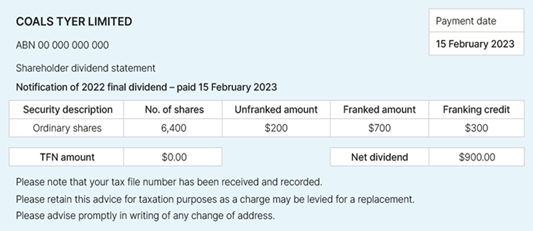

For example, if a company pays you a $700 fully franked dividend, and the corporate tax rate is 30%, it means the company has already paid $300 in tax on your behalf ($700 / (100% – 30%) * 30%). When you declare this income on your tax return, you’ll report $1000 (the $700 dividend plus a $300 franking credit). If your personal tax rate is 30%, the tax on the dividend would be $300, which is exactly covered by the franking credit, resulting in no additional tax on the dividend for you. If your tax rate is lower, you might even get a refund.

Why Consider Fully Franked Dividends?

How fully franked dividends are paid out?

Declaration of Dividends

Dividend Payment

Tax Offset

Key Benefits of Fully Franked Dividends

Shareholders can benefit from tax refunds if their personal tax rate is below the company’s rate.

They make investing in the company more attractive, potentially boosting its share value.

Tax Implications

For the Company

The company won’t get a tax deduction for the dividend payments, but they are a distribution of profits that have already been taxed.

For the Shareholder

The dividend income, plus the franking credits, is included in the shareholders’ taxable income but the franking credits are used to offset the tax due.

What are the Challenges and Considerations?

Franking credits can only be passed on to the extent that the company has paid tax.

The company must have a franking account balance to declare fully franked dividends.

Case Study : John and Jenny’s Homeware Business and the Strategic Use of Fully Franked Dividends

Franking Credit Account: $500,000

Planned Annual Dividend Payout: $50,000 each

The Fully Franked Dividend Strategy:

Each receives a dividend of $50,000.

The franking credit attached to this dividend is $16,666 for each, reflecting the tax the company has already paid.

Their individual taxable income is grossed up to $66,666, which includes the dividend plus franking credit.

However, they are entitled to claim the franking credit of $16,666 each.

This results in a tax refund of about $3,200 each, assuming they have no other income.

Note for Similar Business Owners

Next Steps for Maximizing Your Benefits with Fully Franked Dividends

Unlock the Full Potential of Your Hard-Earned Profits

Consult with Experts

Strategic Financial Review

Personalized Tax Planning

Documentation and Compliance

Ongoing Support and Adjustment

Take the First Step Towards a Brighter Financial Future

Let’s Make It Happen Together

Connect with us today and let’s turn your company’s profits into your personal gain, the smart way.

Ready to Resolve Your Division 7A Loan Challenges? Let's Take Action!

Our team of DIV7A specialists is here to provide you with personalized solutions. Start by completing the Division 7A Loan Assessment Form, and we'll evaluate your situation promptly. Your financial success is our priority.

Start Tax Planning Now

Wondering how to withdraw money from your company while maximizing benefits and minimizing costs? It all starts with effective tax planning.

Book an Appointment

Ready for Personalized Solutions? Schedule Your Appointment!

Talk to a DIV7A Specialist

For expert advice on optimizing your Director’s salary package, please use the form below to get in touch with us: