Running a company means making smart choices, especially about your financial rewards. For directors, a simple and effective way to receive your earnings is through a director’s salary. It’s a clear, tax-wise strategy that fits within legal frameworks and secures a regular stream of income. This approach isn’t just about getting paid; it’s about ensuring your remuneration reflects the effort you invest in your company’s success.

What Is It?

Why pay a Salary to Yourself as a Director

By paying yourself a salary, you’re keeping your financial affairs orderly. When it’s time to pay your staff, you’re on the list too. The amount you receive is your take-home pay, after PAYG withholding taxes are deducted, and it goes directly into your personal account. This makes it easier to distinguish between business and personal expenses and streamlines your financial management.

It’s a clear and straightforward approach. You treat yourself as an employee of the company, which not only makes record-keeping simpler but also ensures compliance with employment and tax laws. In doing so, you take care of your own financial security in a way that’s aligned with the needs of the business.

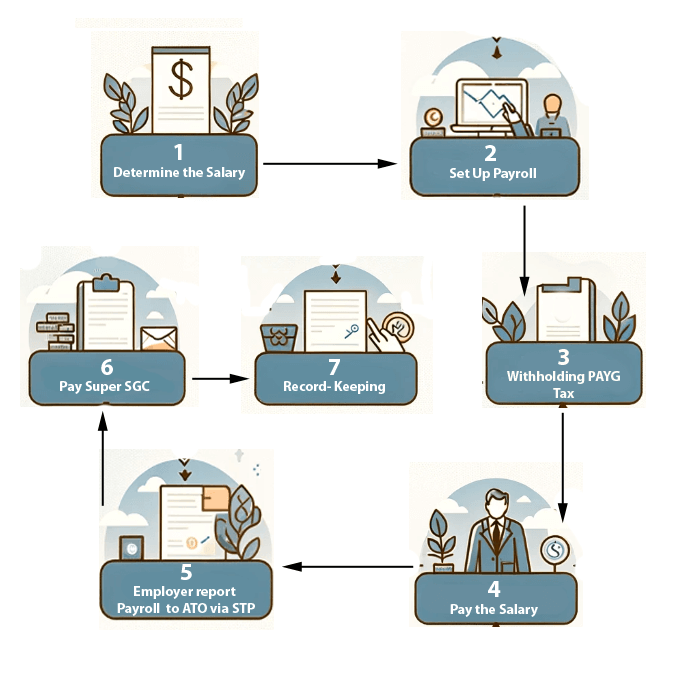

How It Works: A Step-by-Step Guide

Step 1 Determine the Salary

Step 2 Set Up Payroll

Step 3 Withhold Taxes

Step 4 Pay the Salary:

Step 5 Report via STP

Step 6 Manage Superannuation

Step 7 Record-Keeping

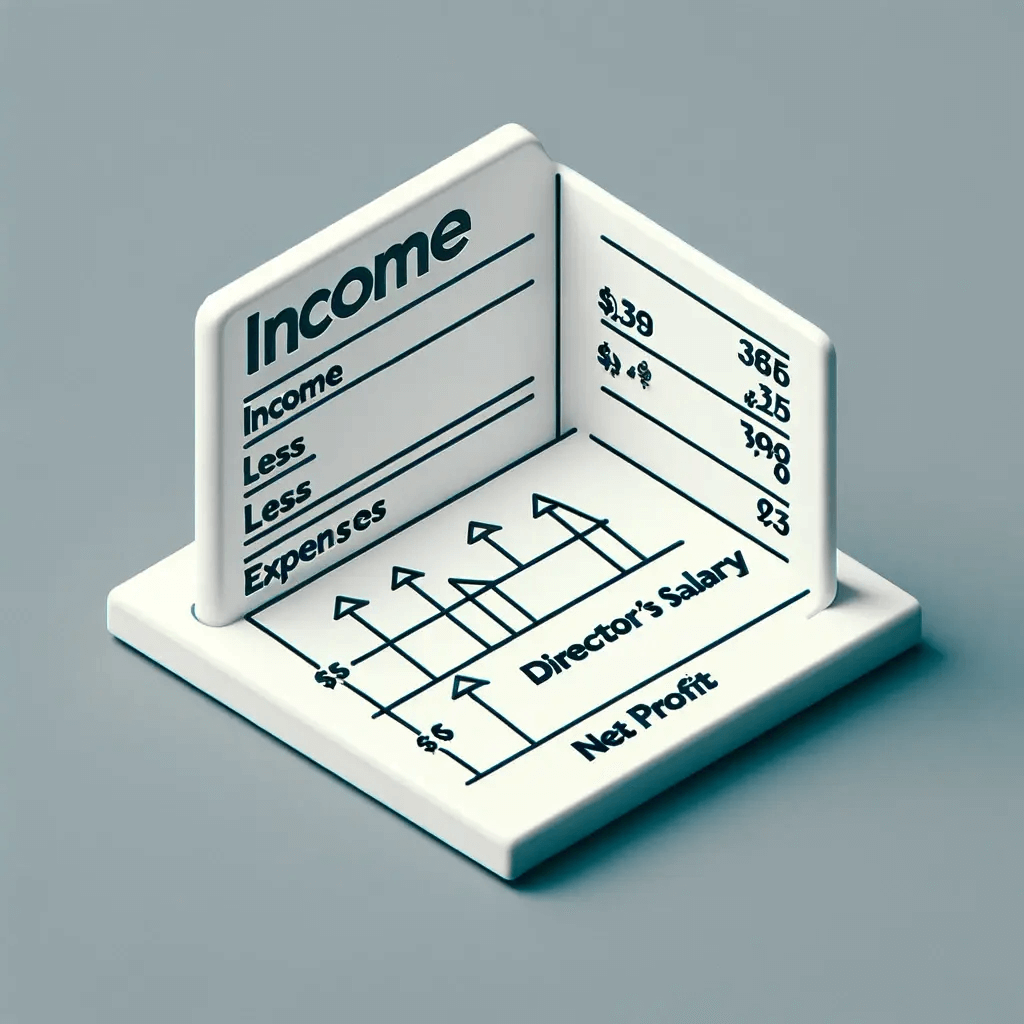

Benefits and Tax Consequences of Paying a Director’s Salary

Benefits to the Company:

Tax Efficiency

Salary disbursements to directors are generally tax-deductible, potentially reducing the company’s taxable income.

Legal Compliance

Strategic Tax Planning

Corporate Governance

Equitable Compensation

Stable Income

Financial Distinction

Transparent Record

Incentivized Performance

Tax Compliance

Superannuation Growth

Regulatory Alignment

Tax Consequences

For the Company

Deductibility: Salaries paid to directors are typically deductible from the company’s income, easing its tax burden.

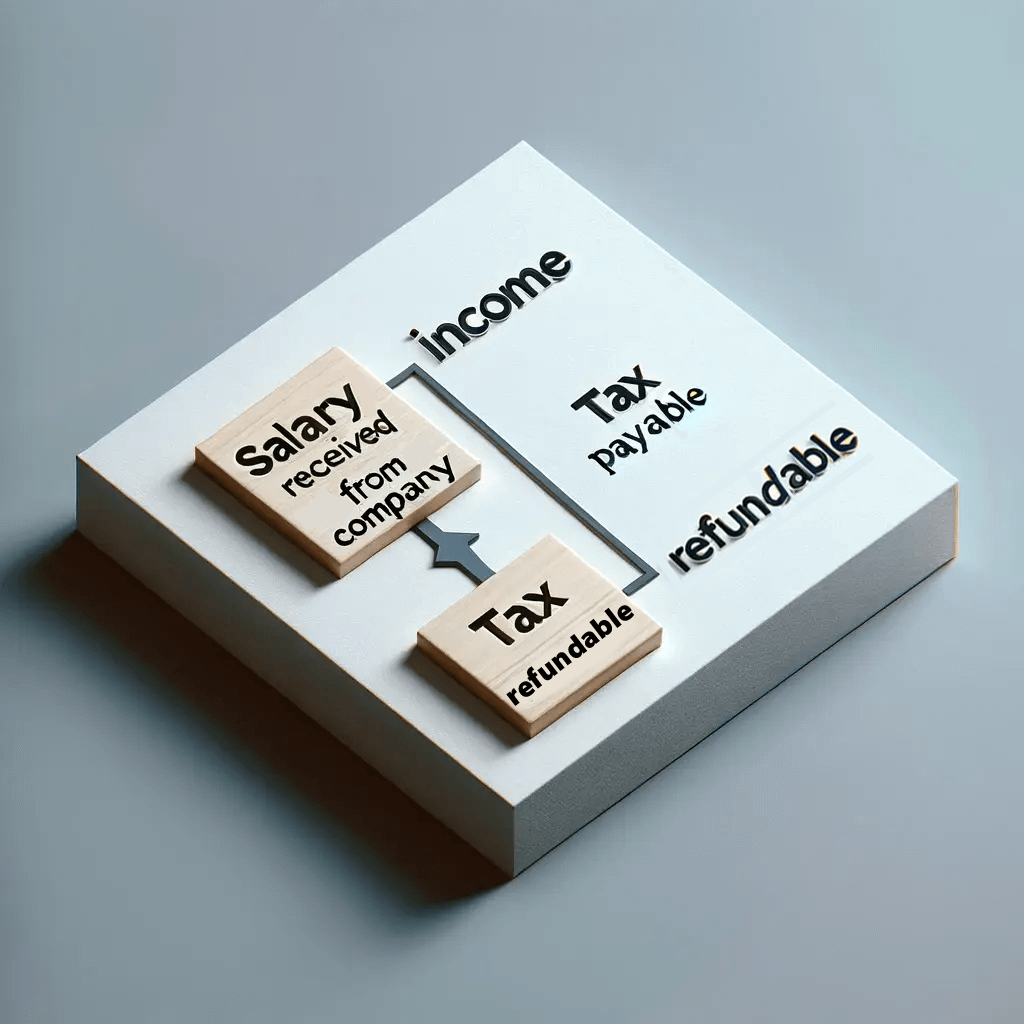

For the Director

Taxable Income: The director’s salary is considered taxable income but is moderated by the PAYG tax already paid during the year.

Super Contributions: Contributions to superannuation are made pre-tax, which can decrease the director’s taxable income.

Year-End Taxation: The final tax position of the director at the end of the Financial year will depend on their total income and the tax credits accrued.

Challenges and Considerations

Reasonableness of Salary

Payroll Management

Cash Flow Impact

Compliance with Tax Laws

Legal and Contractual Obligations

Performance and Remuneration Link

Equity Among Executives

Documentation and Transparency

Director’s Personal Tax Planning

Superannuation Strategy

Case Study: Implementing a Salary Strategy

Mia is the sole director of her graphic design business, “Creative Designs Pty Ltd,” which has seen stable growth.

Ready to Resolve Your Division 7A Loan Challenges? Let's Take Action!

Our team of DIV7A specialists is here to provide you with personalized solutions. Start by completing the Division 7A Loan Assessment Form, and we'll evaluate your situation promptly. Your financial success is our priority.

Start Tax Planning Now

Wondering how to withdraw money from your company while maximizing benefits and minimizing costs? It all starts with effective tax planning.

Book an Appointment

Ready for Personalized Solutions? Schedule Your Appointment!

Talk to a DIV7A Specialist

For expert advice on optimizing your Director’s salary package, please use the form below to get in touch with us: