Published on 17 Jul, 2024

Understanding your trade income: The basics of Personal Services Income

.

If you’re in the trades industry, operating as an electrician, plumber, or in construction, it’s important to understand how your income is classified for tax purposes. The money you earn from your skills and hard work might fall under Personal Services Income (PSI) if you’re running your business through a trust.

Worried about paying too much tax? Book a free consultation with us today to learn how you can pay

just what's necessary.

Navigating PSI for trade professionals

As a tradesperson, whether you’re laying bricks, fixing pipes, or wiring homes, the income you earn may be Personal Services Income (PSI). This term is vital because it’s all about the money you make from your direct labor and expertise, not from selling products or earning from assets.Understanding PSI in your trade business

PSI, or Personal Services Income, was introduced by the government in 2000 to ensure fair taxation. It’s designed to prevent tax minimisation strategies, such as splitting income with family members or claiming excessive deductions that wouldn’t be available to regular employees. These rules are particularly relevant for tradespeople who might operate through various business structures, including companies, partnerships, or trusts. The aim is to make sure the income you earn from your hands-on work, whether it’s electrical, plumbing, or construction, is taxed appropriately. By understanding PSI and its implications, you can better navigate your tax obligations and ensure you’re claiming the right deductions, keeping your business compliant with the Australian Taxation Office (ATO) standards.PSI compliance for sole traders in trades

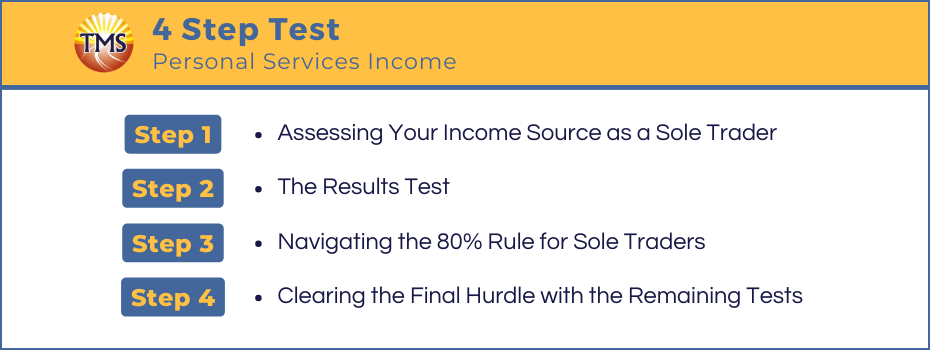

If you’re running a sole trader business in the trades, it’s important to understand how Personal Services Income (PSI) rules might affect you. Before diving into your business full-time, take a moment to assess your PSI compliance using the four steps outlined by the Australian Taxation Office (ATO). You only need to pass one of these four steps to ensure your business doesn’t fall foul of PSI regulations. This means if any one of these criteria is met, your business activities are considered compliant with PSI rules, allowing you to focus on what you do best—be it electrical work, plumbing, or construction—without unnecessary tax complications.Step 1: Assessing your income source as a sole trader

As a tradesperson running your own business, it’s important to look at where your income is coming from. If over half of what you earn is directly from your personal efforts—like the electrical work you do, the pipes you fit, or the buildings you construct—then PSI (Personal Services Income) rules could apply to your situation. If this sounds like your business, it’s time to move on to Step 2 to further evaluate your position regarding PSI.Step 2: The results test for your trade business

In the second step of assessing PSI for your sole trader business, focus on how you’re paid: is it for completing a specific job or simply for the hours you put in? To pass the results test and potentially sidestep PSI concerns, three key criteria need to be met:- Payment for Results: At least 75% of your income should come from delivering specific outcomes. This means you’re paid for the job done, not just the time spent.

- Assumption of Risk: You take on the responsibility for fixing any issues with your work at your own cost.

- Providing Tools and Equipment: You supply all the necessary tools and equipment to achieve the aforementioned results, accounting for at least 75% of your work.

Step 3: Navigating the 80% rule for sole traders

Step 3 in assessing your PSI situation involves examining your client base. Specifically, does 80% or more of your income as a sole trader in the trades come from a single client, or from clients that are connected, such as subsidiaries or partners of the same entity? If so, PSI rules are likely to apply to your business. This rule is designed to ensure your income isn’t overly dependent on one source, which could otherwise resemble an employer-employee relationship. If you find that a large portion of your earnings is indeed from one main client or a group of related clients, it’s time to proceed to Step 4 for further evaluation.Step 4: Clearing the final hurdle with the Remaining Tests

If you’ve reached Step 4 in the PSI assessment for your trade business, it means you need to pass at least one of the following tests to ensure you’re not caught by the PSI rules:Unrelated clients test

This test requires you to have income from at least two clients who are not related to each other, and you must have secured these clients through your own efforts, such as advertising or word of mouth. Remember, clients obtained through a labour hire firm are considered related for this test, which could impact your ability to pass.Employment test

To meet this criterion, you need to have employed other workers to perform at least 20% of the principal work your business undertakes. Alternatively, having an apprentice for at least half the year can also help you satisfy this test. It’s important the work considered here is the main work your business is contracted to do, not ancillary tasks like admin work.Business premises test

For this test, you must have a business location that’s exclusively yours, not part of your home or a client’s site, and you must use this space for more than half of your business activities throughout the year. This space should be the primary place where you earn your PSI. Passing any one of these tests can help ensure your business remains outside the PSI rules, allowing for more flexibility in your tax deductions and overall tax treatment.What doesn’t qualify as a business premises

When it comes to the business premises test for PSI purposes, not all setups make the cut. Here are some examples that don’t pass the test:- Shared working spaces: Simply leasing a desk in a coworking space doesn’t qualify. The test requires exclusive use of the premises, which isn’t the case in shared environments.

- Home offices: Your home office might be where a lot of your work gets done, but it doesn’t satisfy the criteria because it’s not separate from your personal living space.

- Part-year leases: Having an office space only for a part of the year doesn’t meet the requirements, unless your trading commenced within the year and you maintained the lease or ownership for the entire duration of your trading period.

Tax Deduction Limits Under PSI Rules

When Personal Services Income (PSI) rules apply to your business, there are specific restrictions on the tax deductions you can claim against this income. These rules are designed to ensure that deductions claimed are directly related to the earning of PSI, aligning with the principle that PSI should be treated similarly to employment income for tax purposes. When your income falls under Personal Services Income (PSI) rules, there are specific deductions you cannot claim. These include:- Property expenses: Costs like rent, mortgage interest, rates, and land taxes for your home or business premises cannot be deducted against PSI.

- Associate payments: If you pay associates for work that’s not the main service you provide, these payments are not deductible.

- Superannuation for associates: Contributions to superannuation for associates doing non-principal work also fall outside allowable deductions.

Eligible Deductions for PSI Holders

If your income is classified under Personal Services Income (PSI), you can still claim deductions for expenses directly related to earning that income. These can include:- Work acquisition costs: Expenses like advertising, preparing tenders, and submitting quotes that help you secure more work are deductible.

- Professional fees: This covers registration and licensing fees necessary for your trade or profession.

- Banking expenses: Account-keeping fees and related bank charges that are incurred in the course of managing your finances are allowable.

- Insurance premiums: You can deduct costs for necessary insurances, such as public liability and professional indemnity, which protect your business operations.

- Employee costs: Salaries, wages, and super contributions for employees who are not associates and are employed at arm’s length can be deducted.

- Associate payments: Payments made to associates for performing the principal work of your business are allowable, provided they are reasonable.

- Home office running expenses: A portion of your home office costs, including utilities, phone, and internet services, can be claimed. However, fixed costs like rent, mortgage interest, rates, or land taxes are excluded.

Seeking professional advice on PSI

If navigating the PSI rules feels overwhelming or you’re unsure about how they impact your tax situation, especially if you might be operating a personal services business, it’s a good idea to get professional advice. Understanding whether PSI rules apply is crucial for correctly completing your tax return, specifically Item 14 – Personal Services Income. We have extensive experience helping tradespeople and professionals manage their tax obligations and navigate the complexities of PSI rules. Whether you need guidance on your tax liabilities or advice on the most suitable business structure for your operations, our team is here to help. Don’t hesitate to reach out for a consultation to ensure your business is on the right track.Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Book a Consultation

During the session, we will gain an in-depth understanding of your specific needs and develop a plan outlining your properties and next steps.

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

[wpforms id="265551" title="false"]

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.

[wpforms id=”265615″ title=”false”]