How to reduce your Capital Gains Tax (CGT) with the 6-year rule

.

If you’re considering selling your property, it’s crucial to understand how Capital Gains Tax (CGT) might apply to the profit from your sale. This tax could significantly affect your annual income and overall tax obligations.

When you sell a property for a profit, you will likely need to pay Capital Gains Tax. However, there are key exemptions that might help you avoid or reduce this tax. A well-known option is the “6-year rule,” which can be beneficial for property investors. If you used the property as your Principal Place of Residence (PPOR) before renting it out, the 6-year rule allows you to treat it as your main residence for CGT purposes for up to six years. This exemption could enable you to avoid paying CGT if you sell the property within this period.

To learn more about how the 6-year rule can work for you and reduce your Capital Gains Tax, book a consultation with our property tax specialists today.

What you need to know about Capital Gains Tax

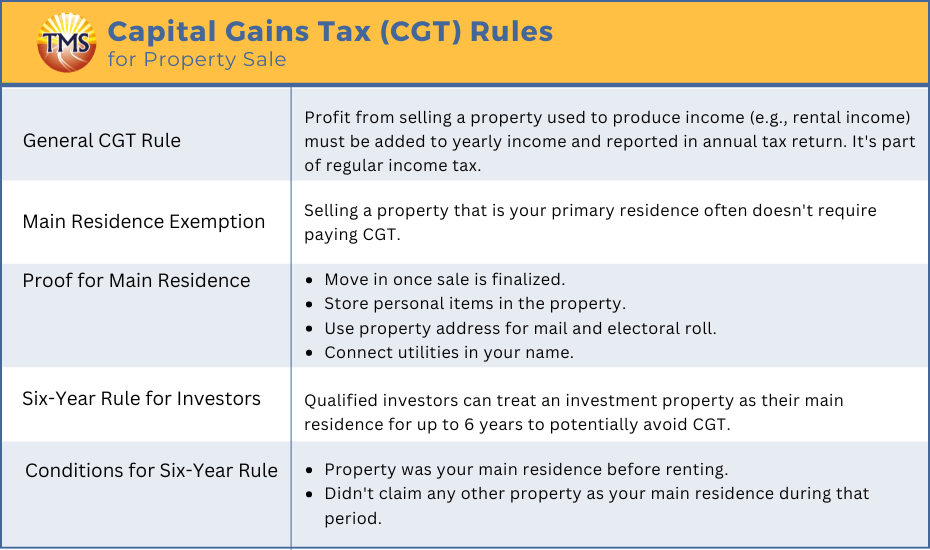

When you sell a property at a profit, the amount you gain is considered a capital gain. This capital gain becomes part of your taxable income for the year and is subject to Capital Gains Tax (CGT). Unlike a separate tax, CGT is included in your annual income tax return, which you submit to the Australian Taxation Office (ATO).

Understanding how CGT works is crucial for property investors, especially when considering the sale of a Principal Place of Residence (PPOR) or any other property. The implications of CGT can significantly impact your overall tax liability, making it important to plan and consider the timing and strategy of your property sales.

What is a Capital Gains Tax event?

A Capital Gains Tax (CGT) event occurs when you sell or dispose of an asset that is subject to CGT. This event is when you either realise a capital gain or incur a capital loss. Several actions can trigger a CGT event, including selling, trading, swapping, or exchanging assets, or if an asset is lost, destroyed, or disposed of involuntarily through a contract.

The type of CGT event relevant to your situation affects the timing and calculation of your capital gain or loss. Property investors often benefit from consulting with property tax specialists to fully understand the implications of a CGT event on their financial situation and ensure accurate tax reporting.

What is the Capital Gains Tax six-year rule?

The Australian Taxation Office (ATO) outlines that when you sell a property that has been used to produce income, such as generating rental income, any profit (capital gain) from that sale must be included in your annual income and reported on your income tax return. This Capital Gains Tax (CGT) is not a separate tax but part of your regular income tax obligations.

However, the ATO provides certain CGT exemptions that can help reduce your tax liability. One significant exemption is available if the property in question is your main residence (or Principal Place of Residence). Generally, you won’t need to pay CGT when selling your main residence.

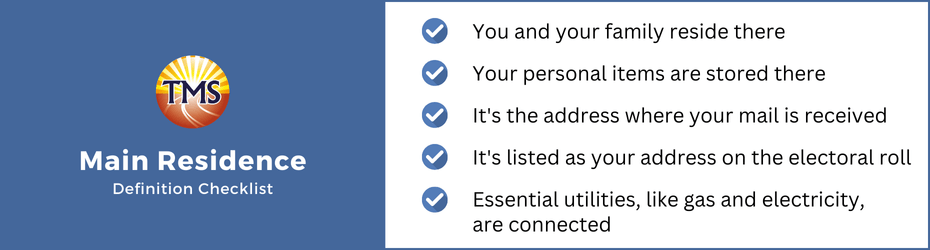

To prove to the ATO that a property is your main residence, you typically need to:

-

Move into the property once the purchase is complete.

-

Store personal belongings at the property.

-

Use the property’s address for mail and as your electoral roll address.

-

Connect utilities like water and electricity in your name.

The duration of your stay and your intent to make the property your permanent home also influences its classification as your main residence. It’s important to note that for the property to qualify, it must have a dwelling on it that you’ve lived in; owning a vacant block of land does not meet the criteria for the main residence exemption.

The six-year rule offers a valuable opportunity for property investors to reduce their Capital Gains Tax liability. This rule allows eligible investors to treat their rental property as their main residence for up to six years, potentially avoiding Capital Gains Tax when they sell the property.

If you lived in a property before renting it out, you could sell it without incurring a Capital Gains Tax liability, provided that:

-

The property was your main residence before you rented it out.

-

You did not claim any other property as your main residence during that time.

Given the complexity of these rules, it’s wise to seek advice from a property tax specialist to ensure you meet all the necessary conditions and make the most of the available tax benefits.

Example: The 6-year Capital Gains Tax exemption in action

Emily purchased an investment property in Sydney, which she designated as her Principal Place of Residence for the entire four-year period she lived there. During this time, the property served as Emily’s home, and she did not earn any rental income, so there were no property tax obligations.

Later, Emily received a job offer in Melbourne for a two-year assignment. She accepted the opportunity and moved to Melbourne, staying with a relative during this period. Emily did not claim any other property as her main residence while living in Melbourne. To generate income, she rented out her Sydney property.

After completing her assignment, Emily decided to settle permanently in Melbourne and chose to sell her Sydney property. By applying the Australian Taxation Office’s six-year rule, she was able to navigate the Capital Gains Tax (CGT) requirements effectively. Understanding the main residence exemption and the absence rule allowed Emily to avoid paying CGT on the sale of her property.

What is the Principal Place of Residence (PPOR)?

The Principal Place of Residence (PPOR) is the main home where you live. This could be a house, flat, unit, or even an unconventional dwelling like a caravan or houseboat. Identifying your PPOR is crucial because it can determine your eligibility for certain tax exemptions, including the main residence exemption, which impacts your capital gains tax liability.

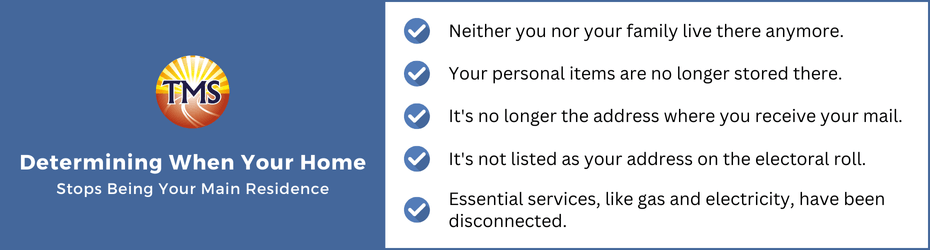

Determining when your home stops being your main residence

A property usually stops being your main residence when you move out. However, for Capital Gains Tax purposes, you can choose to treat your former home as your main residence even if you no longer live there.

Several factors help determine when a property is no longer your primary residence:

-

You or your family no longer live there.

-

Your personal belongings are no longer stored there.

-

It’s no longer the address where you receive mail.

-

It’s not listed as your address on the electoral roll.

-

Essential services, like gas and electricity, have been disconnected.

The significance of each factor depends on your specific circumstances. How long you’ve been away and whether you plan to return can also influence whether the property still qualifies as your main residence for tax purposes.

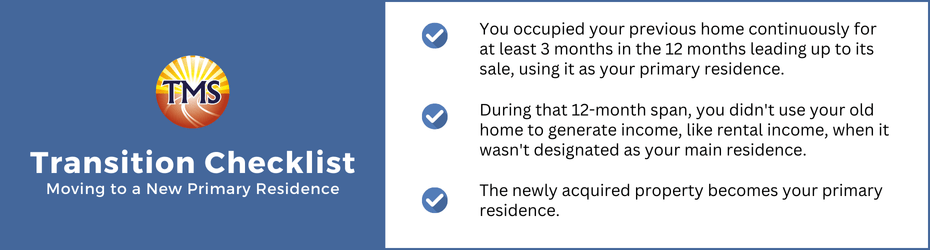

Transitioning to a new primary residence

If you buy a new home before selling your previous one, both properties can be treated as your main residence for up to six months.

This applies if the following conditions are met:

-

You lived in your previous home continuously for at least three months during the 12 months before its sale, using it as your primary residence.

-

During that 12-month period, you did not use the old home to generate income, such as rental income, when it wasn’t designated as your main residence.

-

The newly purchased property becomes your primary residence.

Strategies to minimise your Capital Gains Tax liability

If your investment property doesn’t qualify for a full Capital Gains Tax (CGT) exemption from the Australian Taxation Office (ATO), there are still effective ways to legalyl reduce the Capital Gains Tax payable when you sell the property.

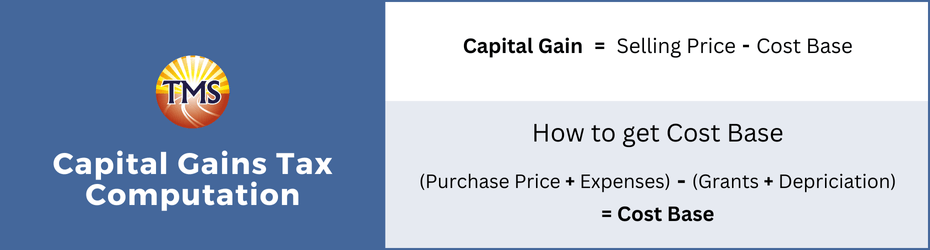

One key approach is to increase the cost base of the property. The capital gain, which is subject to tax, is calculated as the difference between the selling price and the cost base. By adding eligible expenses—such as legal fees, stamp duty, and renovation costs—to the cost base, you can reduce the capital gain and, consequently, the amount of CGT payable.

Understanding and applying these strategies can help you lower your tax liability, making it worthwhile to consult with a property tax specialist to ensure you’re maximising all available deductions and allowances.

Costs you can add to reduce capital gains on investment properties

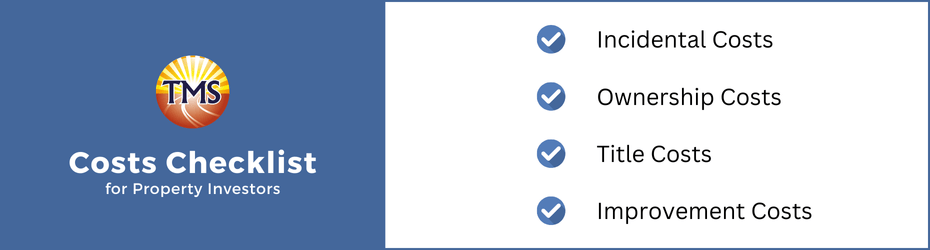

Property investors have the opportunity to reduce the capital gain when selling an investment property by incorporating various costs into the property’s cost base.

Key expenses that can be included are:

Incidental costs

These include fees for advertising the property, legal services, and stamp duty.

Non-deductible ownership costs

Costs related to owning the property that aren’t deductible but can still be added to the cost base.

Title costs

Legal fees associated with establishing or defending the property’s title.

Improvement costs

Expenses incurred for significant improvements, such as upgrading flooring or adding a deck.

By adding these expenses to the cost base, property investors can lower the capital gain, thereby reducing the Capital Gains Tax (CGT) payable when the property is sold. This strategy can lead to a lower assessable income from the capital gain on your annual income tax return, reducing your overall tax liability.

Consulting with a property tax specialist is crucial to ensure you fully understand the CGT implications and take advantage of all available capital gains tax exemptions. In some cases, such as when applying the six-year absence rule, there may even be opportunities to avoid paying unnecessary CGT, particularly if the property was previously your Principal Place of Residence (PPOR).

FAQ

Does the 6-year CGT exemption apply to your main residence?

Does the 6-year CGT rule apply to investment properties?

Can you have two primary residences in Australia?

What is the 'absence rule' in Australian property tax?

Can foreign residents benefit from the 6-year CGT rule?

What is the life events test?

For tailored advice, it’s recommended to consult with property tax specialists who can guide you through the rules set by the Australian Taxation Office.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Book a Consultation

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.