When can Section 100A apply to block a trust distribution?

.

How section 100a affects trust income taxation

Section 100A is an anti-avoidance rule under the Income Tax Assessment Act aimed at preventing tax avoidance through certain trust arrangements. It comes into play when trust income is distributed to one person, but another is considered “presently entitled” to that income, often in situations like reimbursement agreements or loan arrangements. These setups can be used to reduce or defer tax liabilities, which Section 100A seeks to counteract.

If Section 100A applies the trustee may be taxed at the top marginal rate on the beneficiary’s share of the trust’s income. This ensures that trust distributions and income entitlements reflect the actual economic benefits received by the beneficiaries, maintaining alignment with the tax obligations. The ATO dedicates significant compliance resources to monitor and enforce these rules, particularly focusing on higher-risk trust arrangements and ensuring that trust deeds, resolutions, and entitlements are properly managed.

If you have concerns about trust-related tax issues or want to ensure compliance with Section 100A, consider scheduling a complimentary consultation with us. We can assist you in navigating these complex regulations and ensure your trust arrangements meet all legal requirements.

When does Section 100A apply to a trust distribution?

Section 100A of the Income Tax Assessment Act applies to trust distributions that involve reimbursement agreements outside of regular family or commercial dealings. These arrangements occur when a beneficiary is entitled to trust income but does not actually benefit from it, often with the goal of reducing or deferring tax liability.

For Section 100A to apply, the following conditions must be present:

-

Linked Entitlement: The beneficiary’s entitlement to trust income is connected to an agreement, arrangement, or understanding.

-

Benefit to Another: Another person benefits from the trust, either through a transfer of trust property, payment, loan, or provision of services.

-

Tax Reduction Intent: There is an intention by at least one party to reduce or defer income tax.

This rule applies to all types of trusts, including discretionary, fixed, and unit trusts. It’s important to note that a trust becomes a family trust through a “family trust election,” indicating control by a family group.

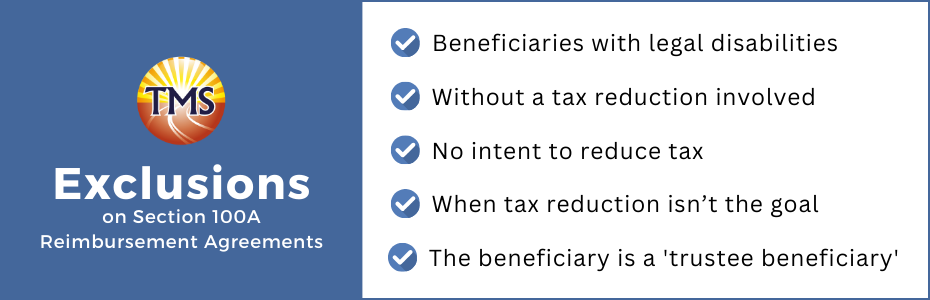

Exclusions on Section 100A reimbursement agreements

Not all trust distributions fall under the scope of Section 100A. Certain exceptions exist, particularly for family trusts that engage in typical family or commercial dealings without the intention of reducing tax liabilities. These exclusions are crucial for ensuring that family trusts can function effectively and legally.

The key exclusions are:

-

Distributions that stem from regular family or commercial dealings, reflecting genuine family relationships or business operations.

-

Trusts that are managed by a family group and pass the family control test.

-

Distributions made without the main aim of tax reduction or deferral.

These exceptions allow family trusts to distribute income and protect assets while staying within legal boundaries. To ensure your trust arrangements are compliant, it’s advisable to consult with a tax professional or refer to the ATO’s guidelines on family trust distributions.

Beneficiaries with legal disabilities

When a trust distribution is made to a beneficiary who is under a legal disability, such as a minor or someone who is bankrupt, Section 100A does not come into play. In these cases, the trustee is tasked with managing and assessing the distribution for the beneficiary. Unless specified otherwise, discussions about beneficiaries in relation to Section 100A typically refer to those who are not under a legal disability.

Without a tax reduction involved

Section 100A does not apply to agreements that were not designed with the goal of reducing tax obligations. If an arrangement was made without the intention of lowering someone’s tax bill, it falls outside the scope of this provision. This means that if the agreement doesn’t aim to reduce or eliminate the tax that would otherwise be due, Section 100A will not be triggered.

No intent to reduce tax

Section 100A does not apply to agreements that were not designed to reduce tax liabilities. If the arrangement was made without the aim of lowering the amount of income tax someone would have to pay, then Section 100A is not relevant. The focus here is on whether the agreement was crafted with the purpose of cutting down on tax obligations. If this intent is absent, the provision doesn’t come into effect.

When tax reduction isn’t the goal

Section 100A does not apply if an agreement wasn’t created with the intention of reducing income tax. This means that as long as the arrangement wasn’t designed to lower the tax obligations of any individual involved, Section 100A isn’t relevant.

The beneficiary is a ‘trustee beneficiary’

Section 100A does not apply when a distribution is made to a “trustee beneficiary,” meaning the distribution is directed to another trust acting as a beneficiary. However, the implications of Section 100A should still be carefully considered, especially within family trust structures, to understand the potential tax consequences of these distributions.

Example of ordinary family dealing under section 100a

Liam and Sarah live with their two children and Sarah’s father, John. John contributes to household chores, but relies on Liam and Sarah for financial support.

Liam and Sarah own a landscaping business through a discretionary trust called LS Green Trust. Liam serves as the trustee. During the 2023–24 income year, the trust distributes $35,000 to both Liam and Sarah. The trustee transfers these funds into their shared bank account. Over the following year, Liam and Sarah use this account to pay for their mortgage, children’s school fees, and household expenses. They’ve also provided John with a linked card that he uses to cover his medication and groceries.

Liam and Sarah manage their household finances together, using the distributed funds to meet the needs of their family, including John. This type of arrangement is typically seen as an ordinary family dealing, aligning with regular family financial practices.

Tax consequences of a reimbursement agreement

When Section 100A applies to a family trust distribution, it results in specific tax outcomes:

Beneficiary’s entitlement nullified

When Section 100A applies, the beneficiary’s entitlement to the trust income is retroactively revoked. This means the beneficiary is considered never to have had any claim or right to that income from the outset.

Income recharacterisation

The income that was initially allocated to or received by the beneficiary is recharacterised, effectively being treated as if it were never distributed to them.

Trustee’s tax obligation

The trustee becomes responsible for paying tax on the income originally allocated to the beneficiary, at a rate of 47%, which includes the top marginal tax rate and the Medicare levy.

Beneficiaries affected by Section 100A can amend their tax returns to reclaim any tax they previously paid. This option is available regardless of any default beneficiary clause in the trust deed or the type of trust income involved.

Section 100A can also impact the allocation of capital gains or franked dividends to beneficiaries, potentially leading to a reshuffling of how income is distributed. In such cases, the trustee may face additional tax assessments under Section 99A.

It’s important to note that while Section 100A affects tax obligations, it does not invalidate trust distributions under trust law. This distinction can lead to legal and practical challenges, including complexities in accounting for both the trust and its beneficiaries, as the distributions remain legally valid even if the tax treatment changes.

Example scenario

Consider a situation where a family member beneficiary has already received a trust distribution, and the corresponding tax has been paid. If the ATO later determines the distribution is invalid under Section 100A, the trustee becomes liable for tax on the beneficiary’s share of income at the highest marginal rate.

While the beneficiary may be able to amend their tax return to seek a refund, trust law typically does not require them to return the distributed funds. This creates a challenging scenario where the trustee must manage the tax liability without recovering the distributed amounts, potentially complicating the ongoing operations of the family trust.

How the ATO assesses section 100A risk

On 23 February 2022, the Australian Taxation Office (ATO) released draft guidelines outlining their initial approach to enforcing Section 100A compliance for family trusts and businesses. These early guidelines sparked considerable controversy and criticism.

Following extensive consultation, the ATO published the final Section 100A compliance guidelines on 8 December 2022, as PCG 2022/2, along with a compendium that addressed the feedback received. The final version introduced more detailed scenarios that are exempt from ATO scrutiny, providing clearer guidance. However, concerns remain, particularly regarding distributions made to adult children of the trust controllers.

The final guidelines underscore the importance of creating tax-effective trust structures that not only benefit future generations but also safeguard family assets. The ATO’s Section 100A Compliance Guidelines offer a structured approach to evaluating and categorising the risk associated with trust distributions, specifically within family trusts and businesses.

Essential records for section 100A compliance

Maintaining thorough records of your trust transactions is essential for Section 100A compliance. Clear documentation of why and how entitlements were managed helps support your position and facilitates a smooth review process by the ATO.

Key Records to Keep:

- Trust Deed and Amendments: Keep the original trust deed along with any amendments, trustee resolutions, and up-to-date contact details of the trustee.

- Inter-Party Loans: If your trust involves loans between parties, retain copies of the loan agreements and detailed records that explain the purpose and terms of the loan.

- Beneficiary Entitlements: Maintain evidence that shows the beneficiary has received or benefited from their entitlement. This could include bank statements, payment receipts, or other financial records.

Even though intra-family arrangements may be less formal than commercial dealings with unrelated parties, it is still crucial to keep contemporaneous records. These records should clearly document the objectives of the arrangement and how they were achieved. Trustees, or their registered tax agents, should ensure that these records are comprehensive and well-organised to demonstrate compliance with tax laws and the intended outcomes.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Book a Consultation

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.