Setting Up a Family Trust: A Practical Guide

.

When it comes to securing your financial future and planning ahead, a family trust is a powerful tool. It’s a smart way to protect what you own, save on tax, and leave a legacy. One increasingly popular approach is the creation of a family trust. This article will walk you through the essential elements of a family trust, its benefits, and the step-by-step process for its formation, using a real-life case study as an illustration.

What is a Family Trust?

A family trust is like a carefully managed safe box that holds and safeguards valuable assets on behalf of your family members. Think of a parent setting aside money for their child’s future. Similarly, a family trust is a legal structure designed to protect and oversee assets like property, investments, or a family business.

This ensures your assets are preserved and used according to your intentions, with potential tax advantages and a lasting legacy. Picture this arrangement on a larger scale—a legal structure overseeing valuable assets, managed by a trustee for your family’s benefit.

This trustee holds wide-ranging discretion, distributing income and capital to beneficiaries, and even managing business operations. By strategically handling income, the trustee can minimise tax burdens across the family and protect assets from potential creditors. In essence, a family trust functions as a smart tool for asset protection, tax planning, and creating a lasting family legacy.

Book a free consultation with us today to learn

how you can pay just what's necessary.

What are the benefits of setting up a family trust?

When you decide to set up a family trust, you’re taking a smart step that comes with many advantages. Let’s take a closer look at why this is a good idea and how it can help you:

Tax Efficiency: Maximising Your Financial Health

By setting up a family trust, you’re opening doors to smart tax planning. This enables you to efficiently distribute income and capital gains among beneficiaries, resulting in reduced tax obligations and a healthier financial profile for your business.

Protecting Your Family’s Wealth with a Family Trust

Imagine having a safety net that keeps your valuable belongings safe from unexpected troubles. A family trust acts as this safety net, ensuring the security of your valuable possessions like property, business, and investments. It safeguards them from personal responsibilities and potential risks, giving you peace of mind for the future. By setting up a family trust, you’re building a solid foundation to preserve and grow your family’s wealth over time.

Flexible Income Management: Tailoring Benefits to Your Family

The beauty of a family trust lies in its flexibility. It allows you to distribute income to family members based on their specific needs and circumstances, maximising tax advantages and optimising financial gains.

Securing the Future: Ensuring Continuity and Succession

In the always-changing world of business and investing, things are always shifting. A family trust gives you peace of mind by making sure your business or investment keeps going well, even as things change around you.

Strategic Property Investment: Opening New Opportunities

Unlike the limits of strict SMSF Self-Managed Super fund rules, a family trust provides the freedom to strategically invest in property. This path unlocks potential for diversification and growth, enriching your investment portfolio.

Capital Gains Tax Advantage: Unlocking Favourable Taxation

When it comes to Capital Gains Tax (CGT), family trusts have a distinct edge. The favourable 50% discount factor on capital gains, applicable to assets retained for over a year, presents a compelling advantage not found with other structures like companies.

In Simple Words: How a Family Trust Can Help You

Setting up a family trust is like getting a special tool to keep your money safe and pay less tax. By using the benefits we talked about, you can make sure your money works for you and your family in the best way possible. So, think about a family trust as a way to keep your money safe and help it grow over time.

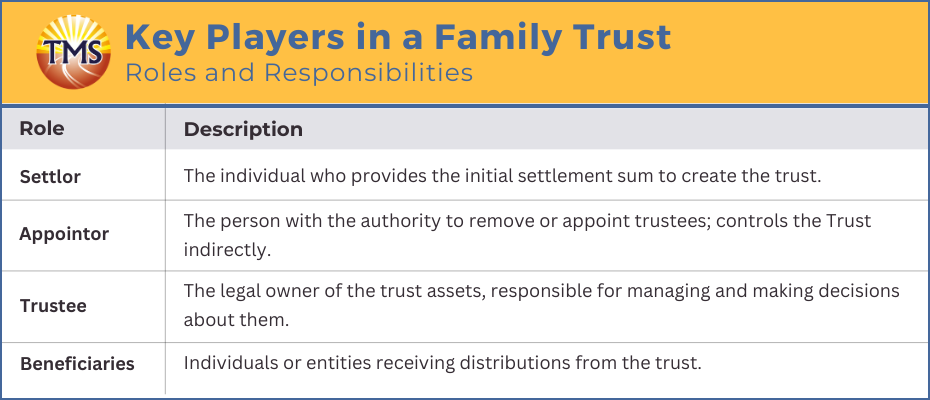

Understanding Family Trusts and Key Players

A family trust is a legal entity that is designed to securely manage, distribute, or invest assets for the benefit of specific family members or other designated beneficiaries. Within this framework, there are several key roles that contribute to the effective administration and management of the trust’s assets:

- Settlor: The individual who provides the initial settlement sum to create the trust.

- Appointor: The person with the authority to remove or appoint trustees. In essence they control the Trust from behind the veil of the Trustee.

- Trustee: The legal owner of the trust assets who manages and makes decisions regarding them.

- Beneficiaries: Individuals or entities receiving distributions from the trust.

Are All Family Trusts the Same?

No, family trusts come in various forms. A family trust is a distinct type of discretionary trust, and there are different variations, each tailored to specific purposes. Let’s explore some of these variations to help you grasp their differences and the importance of selecting the right one to suit your needs.

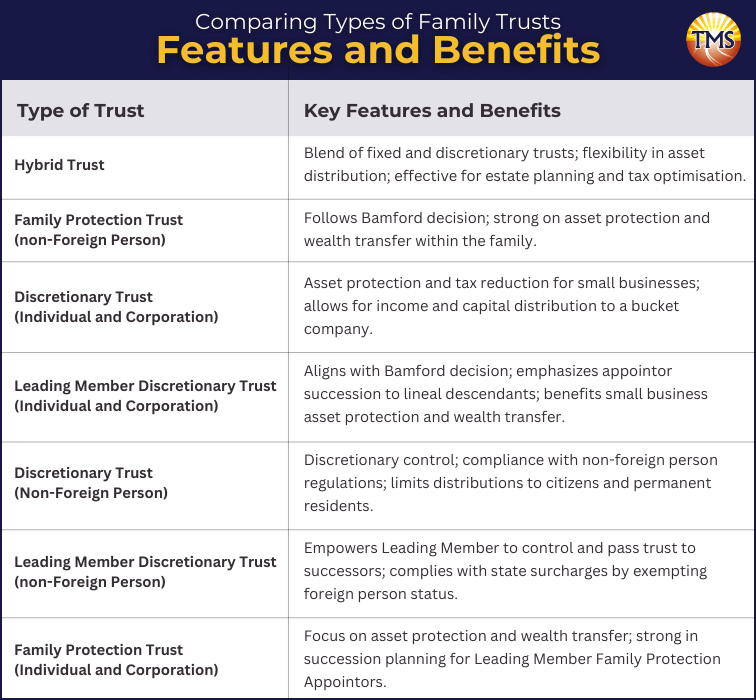

Types of Family Trusts

- Hybrid Trust: A special blend of fixed and discretionary trusts, offering flexibility and control in distributing assets. Provides predictability for certain beneficiaries and is effective for estate planning and tax optimisation.

- Family Protection Trust (non-Foreign Person): A discretionary trust following the Bamford decision, focusing on the succession of Leading Member Family Protection Appointors. Strong on asset protection and wealth transfer within the family.

- Discretionary Trust (Individual and Corporation): Offers asset protection and tax reduction for small businesses. Income and capital distribution to a bucket company with various beneficiary options.

- Leading Member Discretionary Trust (Individual and Corporation): Aligns with Bamford decision, emphasises appointor succession to lineal descendants. Allows appointor to designate lineal beneficiaries, benefiting small businesses’ asset protection and wealth transfer.

- Discretionary Trust (Non-Foreign Person): Offers discretionary control while complying with regulations for non-foreign persons. Limits distributions to citisens and permanent residents, preventing surcharges.

- Leading Member Discretionary Trust (non-Foreign Person): Empowers Leading Member to control and pass trust to successors. Exempts beneficiaries, trustees, and appointor from foreign person status, ensuring compliance with state surcharges.

- Family Protection Trust (Individual and Corporation): A discretionary trust with a focus on asset protection and wealth transfer. Strength lies in succession planning for Leading Member Family Protection Appointors.

Choosing the Right Trust for Your Purpose

When it comes to property, experts recommend a specialised non-foreign person discretionary trust. This provides protection against potential surcharge stamp duty and land taxes, even if foreign beneficiaries aren’t directly involved.

If you aim to protect your assets and pass on wealth or a business to your bloodline, consider the Leading Member Discretionary Trust (LMDT). Aligned with the Bamford decision, the LMDT focuses on successful appointor succession to your bloodline, like your children or grandchildren.

Within the LMDT, the appointor holds significant power, even having the authority to designate a spouse as a lineal beneficiary. Non-linear beneficiaries take a secondary role to core primary beneficiaries, often your bloodline. If non-linear beneficiaries are part of the picture, the Standard Discretionary Trust is a more fitting choice.

Ensuring Asset Protection and Wealth Transfer

For small business owners, protecting assets and ensuring a smooth transfer of wealth are extremely important. The right family trust can provide both. By clearly understanding your goals—whether it’s keeping property safe, preserving wealth, or supporting a family business—you can confidently explore the different family trust options that are available.

Each type of family trust offers specific benefits tailored to different needs. Depending on your situation—whether you’re focused on protecting assets, optimising your taxes, or securing a long-lasting financial legacy—you have the freedom to select the trust that aligns with your objectives. Remember, family trusts are not all the same. Many people assume that setting up a family trust is a standard process, but in reality, it’s quite diverse.

If you already have an existing family trust, upgrading or making changes should be approached with caution. The issue lies in resettlement. Altering the terms of the deed or the beneficiaries could potentially trigger a resettlement, which requires careful consideration. Making changes to your trust structure may have unintended consequences, so it’s crucial to navigate any alterations with care and expert guidance. Your family’s financial well-being hinges on making the right decisions for your unique situation.

Step-by-Step Process of Setting Up a Family Trust

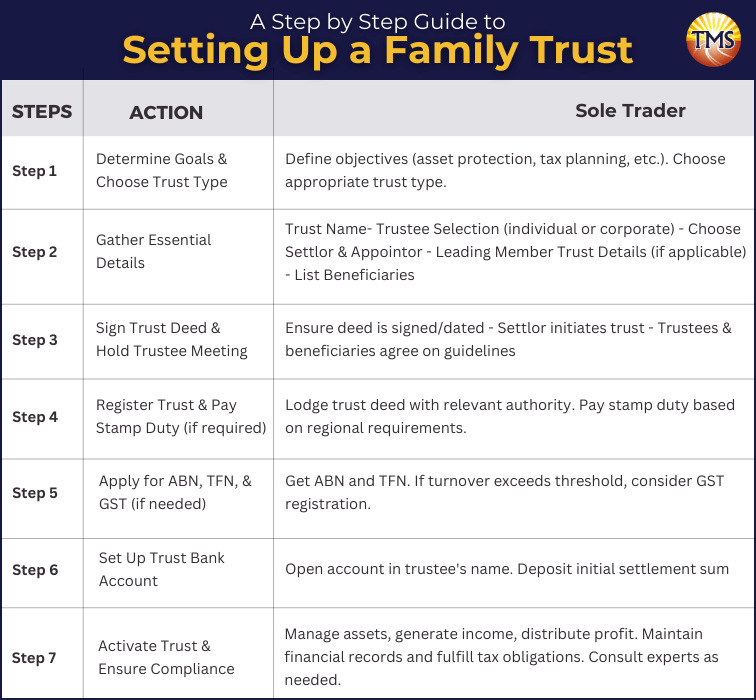

Step 1: Determine Your Goals and Choose the Right Type of Family Trust

Clearly define your objectives for setting up the family trust, such as asset protection, tax planning, succession planning, and separation of business and personal assets. Select the appropriate type of family trust based on your goals and needs, considering factors like control, beneficiaries, and distribution of income and assets.

Step 2: Gather Essential Details for Trust Documentation

Trust Name: Choose a name that represents your trust’s purpose

Trustee Selection: Decide between an individual or a corporate trustee. A corporate trustee offers advantages like asset protection, continuous management, and stability during personnel, director, or shareholder changes.

Choose a Settlor: Select the person who initiates the trust (settlor).

Choose an Appointor: Decide who has the power to appoint and remove trustees (appointors).

Leading Member Family Trust (if applicable): If you choose this option, provide details for Leading Member 1, Leading Member 2, and successors. This ensures smooth management transitions.

List Primary and Potential Beneficiaries: Clearly state the individuals or entities that will benefit from the trust. Make sure it aligns with your family dynamics and trust goals.

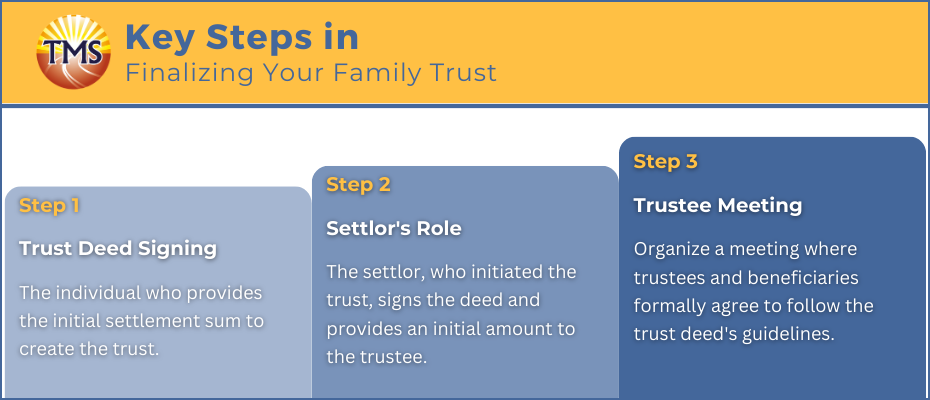

Step 3: Sign Trust Deed and Hold Trustee Meeting

In this step, it’s time to sign the trust deed and complete the necessary actions:

- Trust Deed Signing: Make sure the trust deed is properly signed and dated. This is an important legal step.

- Settlor’s Role: The settlor, who initiated the trust, signs the deed and provides an initial amount to the trustee.

- Trustee Meeting: Organise a meeting where trustees and beneficiaries formally agree to follow the trust deed’s guidelines.

By signing the trust deed and getting everyone involved on the same page, you’re setting a strong foundation for your family trust’s operation.

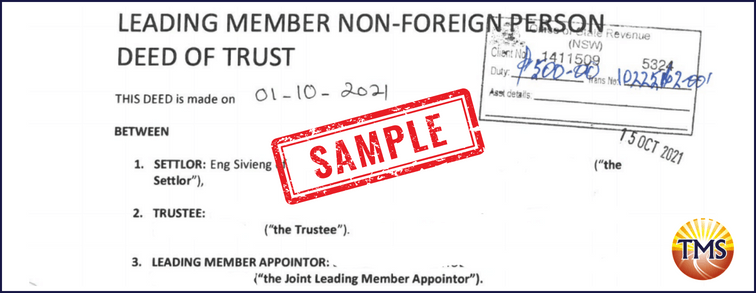

Step 4: Register Family Trust Deed and Pay Stamp Duty (if Required)

- After signing your family trust deed, the next critical step is to lodge it for assessment with the Office of State Revenue or the relevant territorial authority where your trust was established.

- Certain states impose a stamp duty requirement in connection with family trust deeds. This duty must be settled within a specified timeframe.

- For instance, if you’re setting up a new discretionary family trust in New South Wales, you’ll be obligated to pay a stamp duty fee of $500 within a three-month period. Similarly, Victoria enforces a $200 fee that’s due within 30 days, while the Northern Territory and Tasmania have fees of $20, which should be paid within 60 days and 3 months respectively.

- Meeting these stamp duty obligations is essential to ensure full compliance and legal recognition of your family trust. It is advisable to meticulously track deadlines and payment amounts to avoid any unnecessary complications or delays.

Step 5: Apply for ABN, TFN, and Consider GST Registration

Obtain an Australian Business Number (ABN) and Tax File Number (TFN) to establish the trust’s official tax identity. Should your family trust engage in business activities involving an estimated turnover that goes beyond the designated threshold, it may be advisable to contemplate registering for Goods and Services Tax (GST).

Step 6: Set Up a Dedicated Trust Bank Account

Open a bank account specifically for the trust in the trustee’s name. This account will serve as the central hub for managing all financial transactions related to the trust.

Ensure that the initial settlement sum is deposited into this newly established bank account to initiate the trust and enable future transactions, investments, and operations.

Step 7: Activate Your Family Trust and Ensure Compliance

Now it’s time to set your family trust in motion. Put your plan into action: manage trust assets, generate income, and distribute profit as laid out in the family trust deed.

Keep accurate financial records and fulfill tax obligations in line with regulations. Seek guidance from legal, financial, and tax experts to ensure compliance and alignment with your goals.

In essence, start implementing your family trust plan by managing assets, generating income, and distributing gains as specified. Keep detailed financial records and meet tax obligations as required. Consult experts to ensure compliance and achieve your goals.

Setting Up a Family Trust: A Simplified Case Study

Meet David and Jenny, a hardworking couple running a successful cleaning business as a partnership for several years. They own three properties, including their mortgage-free home. Worried about tax, ATO debts, and potential risks to their personal assets, they approached TMS Financial, seeking guidance on how to secure their financial future.

Understand Goals and Choose the Right Trust Type

We began by understanding their Goals: want to lower tax, protect assets, and invest in properties. We recommended a Leading Member Family Trust for its asset protection benefits. David assumed the role of the risk person, while Jenny focused on asset management. This way, they could protect their personal assets while managing the business.

Gathering Essential Details

Appointing and Removing the Trustee

- Defining Trustee Powers and Compensation

- Identifying Relevant Beneficiaries

- Describing Income and Capital Distribution Mechanisms

- Defining Investment Powers, Including General Authorities

- Allowing for Future Amendments

- Addressing Responsibilities for Financial Records

- Outlining Procedures for Winding Up the Trust

Once prepared, the documents are sent to David and Jenny for execution. The settlor signs and dates the documents and contributes the necessary $10 to the trustee.

Register Trust Deed and Pay Stamp Duty

We lodged the trust deed with the Office of State Revenue and David paid the stamp duty of $500. This ensured legal recognition and compliance.

Obtain ABN, TFN, and Register for GST

We apply for an ABN and TFN for the CleanExpert Family Trust, and also register for GST.

Establish a Bank Account for The CleanExpert Family Trust

David and Jenny initiated the setup of a dedicated bank account for the trust. The account’s full name should be “CleanExpert Pty Ltd as Trustee for The CleanExpert Family Trust.” This account will be the central hub for all business-related income and expenses, ensuring efficient management of financial transactions.

Activate Your Family Trust and Ensure Compliance

Put your trust plan into action by managing assets, generating income, and distributing profits as outlined in the trust deed. Keep accurate financial records and meet tax obligations. We offer expert assistance for tax compliance, including BAS, Payroll & STP, and trust tax returns. Our streamlined approach with XERO and DEXT ensures smooth accounting and record-keeping. With our guidance, David and Jenny focused on growing their business and property investments while we handled their tax responsibilities. Trust in us for efficient compliance and financial success.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.

[wpforms id=”265615″ title=”false”]