How to make loan repayments to shareholders for Division 7a

.

Are you aware of the benefits of using loan repayments to return funds to shareholders, compared to other methods like dividends? This approach involves repaying funds that shareholders initially lent to the company, treated as a return of capital rather than profit distribution, which offers distinct financial advantages.

Loan repayments to shareholders are not typically recognised as income, thereby avoiding additional taxation. This not only enhances tax efficiency, it also allows for more flexible management of company cash flow. By adhering to specific provisions like those under Division 7A of the Income Tax Assessment Act, these repayments can maintain their tax-exempt status, ensuring compliance and financial prudence.

If you need assistance in setting up a shareholder loan agreement or managing the intricacies of such financial arrangements, our experts are here to help. We can provide guidance on structuring your loan agreements to meet legal standards, managing accrued interest, and ensuring your financial dealings are both tax-efficient and compliant with the law. Contact us today to ensure your shareholder loan repayments are handled correctly and benefit your business’s financial strategy.

What Are Loan Repayments to Shareholders?

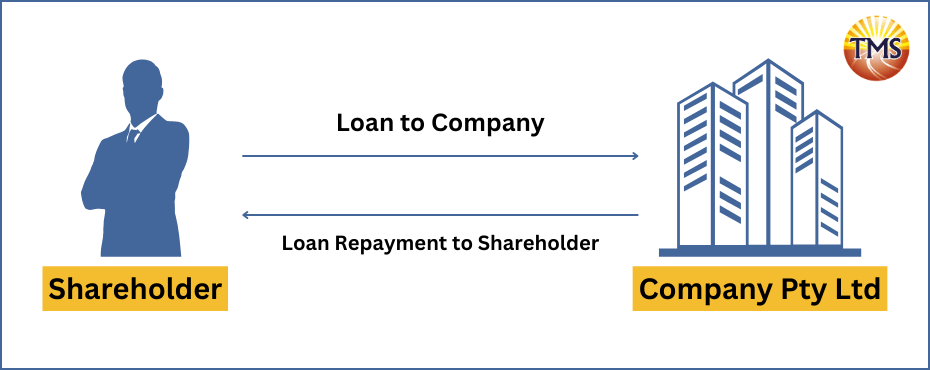

When a company repays funds to its shareholders that were initially provided as loans, this is handled through a shareholder loan agreement. This repayment is different from issuing dividends or paying salaries because it represents the return of capital, not the distribution of profits. The terms of the repayment, such as the principal amount, interest rates where applicable, and due dates, are outlined in the loan agreement. This ensures the process is in compliance with the legal contract between the shareholder and the company.

Why Choose Shareholder Loan Repayments?

Managing shareholder loans involves careful consideration of tax implications, compliance with legal standards, and strategic financial planning. Here’s how structured repayments of these loans can benefit your business:

Tax Efficiency

Repayments from shareholder loans are not typically regarded as income, which helps avoid additional taxes.

Division 7A Compliance

When loan repayments are structured correctly, they are not classified as dividends under Division 7A, preserving their status as tax-exempt.

Cash Flow Management

These repayments provide flexibility in managing the company’s cash flow, allowing payments to be scheduled when financially suitable for the business.

How Shareholder Loan Repayments Work

Here’s how the process of managing shareholder loans works:

Documentation of Loan

When a shareholder or director initially lends money to the company, a formal loan agreement is created. This legal contract specifies all essential details, such as the unpaid principal amount loan, accrued interest, repayment terms, and the due date.

Loan Repayment Schedule

The company commits to a structured repayment plan based on the terms set out in the loan agreement. This may involve regular payments until the full amount is repaid or might be structured as a lump sum payment, depending on the agreement’s provisions.

Avoiding triggering Division 7A

To ensure that repayments are not classified as dividends, strict compliance with Division 7A of the Income Tax Assessment Act is necessary. This compliance helps maintain the repayments’ tax-free status and avoids additional tax liabilities.

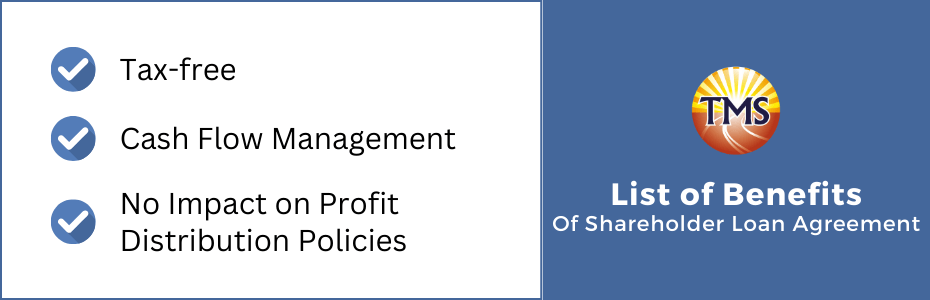

Benefits of shareholder loan agreement

When managed properly, shareholder loans can provide several financial benefits to both the company and its shareholders. Here are some of the key advantages:

Tax-free

The amount repaid on the loan is not taxed as income for the shareholders or directors, which can offer significant tax savings.

Cash Flow Management

Structured repayments provide flexibility in managing the company’s cash flow, allowing the business to plan financially without strain.

No Impact on Profit Distribution Policies

Loan repayments are distinct from dividends and do not influence the company’s policies regarding profit distribution. This ensures that the repayment of shareholder loans does not interfere with the dividends paid to other shareholders.

Tax Implications of a Shareholder loan agreement

Here are the tax implications of shareholder loan repayments for both the company and the shareholders:

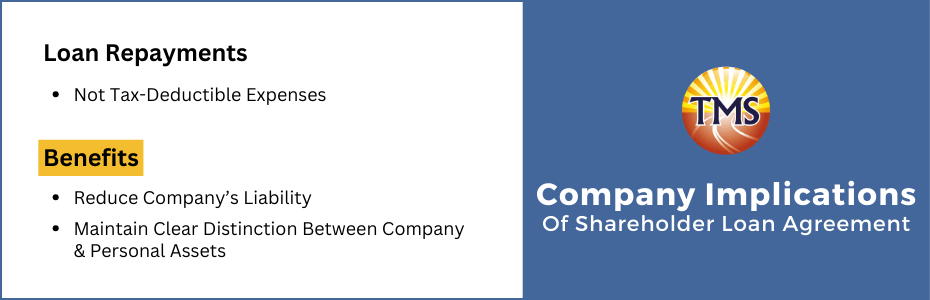

Company Implications of Shareholder Loan Agreement

While the repayments of loans made by the company are not tax-deductible, they help reduce the company’s liabilities. This practice aids in maintaining a clear separation between company funds and personal assets of the shareholders or directors.

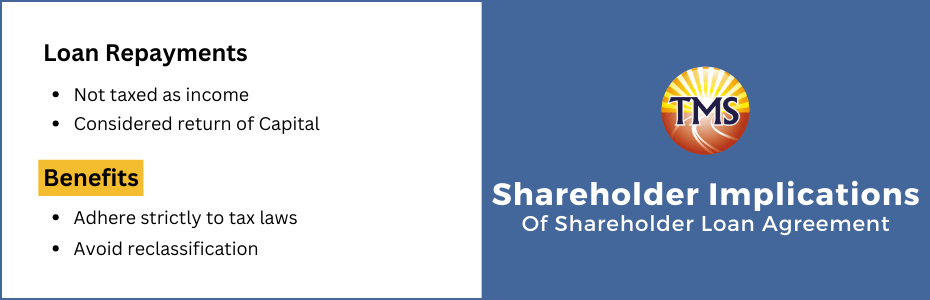

Shareholder Implications of Shareholder Loan Agreement

Funds returned to shareholders are not taxed as income because they are considered a return of the capital initially invested or loaned. It is crucial, however, that both the loan and its repayment follow tax laws closely to prevent these transactions from being reclassified in a way that could impact their tax treatment.

Potential Challenges to Shareholder Loan Agreements

The company needs to ensure that there is adequate documentation to verify that the transactions are legitimate loan repayments. It is crucial to adhere to Division 7A regulations to avoid these repayments being reclassified as dividends.

Potential Risks and Considerations of Shareholder Loan Agreements

Compliance Risks

If the loan is not correctly documented or repayments are not made according to the agreement, there’s a risk of the ATO reclassifying the repayments as dividends, which would be taxable. Ensuring compliance with Division 7A of the Income Tax Assessment Act is essential to avoid such re-characterisation.

Financial Planning

The company must ensure that it has sufficient cash flow to make repayments without jeopardising its operational capacity. Careful financial planning is necessary to manage accrued interest, repayment terms, and any outstanding principal amounts effectively.

Our Services

Loan Repayment Planning

We provide personalised guidance to structure your loan repayments in a tax-efficient and compliant manner. Whether you’re navigating a shareholder loan agreement, loan agreement, or shareholder loan agreement template, we ensure your documentation meets Division 7A requirements.

Documentation and Compliance

Our team assists in documenting the loan and its terms, ensuring adherence to the Income Tax Assessment Act. From accrued interest to interest rates, we cover all aspects to safeguard your interests in legal contracts and agreements.

Financial Health Checks

We conduct financial analysis to ensure your company’s ability to make loan repayments without compromising its financial stability. Whether it’s a secured loan, interest-free loan, or additional funding for tax purposes, we help you navigate repayment terms and obligations to keep your business on track.

How We Can Help

By establishing transparent loan agreements with documented terms and conditions, we guide you through the process of structuring repayment schedules that align with your company’s financial situation. Our focus is on ensuring that loan repayments are executed in compliance with Division 7A and pertinent tax regulations.

Case Study: John’s Bakery Pty Ltd

Background

John is the sole shareholder of a bakery business which operates as a Pty Ltd company in Australia. He initially financed the business by lending $300,000 to the company to cover the purchase cost. This loan amount was recorded as a liability on the company’s balance sheet. Over time, the bakery has become profitable and accumulated a significant cash balance. John now wishes to withdraw $200,000 from the company. He plans to use this money to give to his son as a deposit for his first home.Objective

John seeks to withdraw $200,000 from the company as a repayment of the loan he initially provided, without incurring personal tax liability on the amount and ensuring compliance with Division 7A of the Income Tax Assessment Act 1936.Considerations

Loan Repayment vs. Dividend: A repayment of the principal loan to John does not constitute a dividend and is not taxable as income to John. Division 7A Compliance: Despite being a loan repayment, it is a common misconception that Division 7A does not apply. In fact, Division 7A may apply if the loan from the company to a shareholder does not meet certain criteria.Steps Taken

Verification of Initial Loan Agreement: The company verifies that there was a formal loan agreement in place when John lent the money, detailing the interest rate (if any), repayment schedule, and loan term. Adherence to Loan Terms: The company ensures that any repayments made to John are in accordance with the established loan agreement terms. Documentation and Records: All transactions and repayments are thoroughly documented, and records are maintained to demonstrate compliance with the loan terms.Outcome

John’s withdrawal of $200,000 is processed as a loan repayment by the company. There is no personal income tax for John on the loan repayment because it is a return of capital. The company maintains proper documentation to confirm that the transaction aligns with Division 7A requirements.Division 7A Clarification

Care was taken to ensure the repayment met all criteria to not be treated under Division 7A rules, which could have reclassified the withdrawal as a dividend, subjecting it to tax.Expert Opinion

John can indeed proceed with the loan repayment without attracting personal tax, provided all actions are transparent and in strict adherence to the ATO regulations. However, to avoid any confusion and ensure absolute compliance, it is recommended that John consult with a tax professional who can review the specific details of the loan agreement and provide advice on the correct procedures to follow under Division 7A.Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Frequently Asked Questions (FAQ)

What is a loan repayment to a shareholder?

A loan repayment to a shareholder is when a company returns funds to a shareholder that the shareholder had previously lent to the company. It is treated as a return of the shareholder’s investment rather than income.

How does a loan repayment differ from receiving dividends?

What is Division 7A and how does it relate to loan repayments?

What documentation is required for a loan repayment?

Can a shareholder loan repayment be taxed?

What are the primary benefits of repaying loans to shareholders?

What are the tax implications for the company and shareholders?

Can you outline potential challenges with this method?

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.