Single touch payroll phase 2 in 2023

.

What is single touch payroll?

Single Touch Payroll (STP) is a streamlined payroll reporting system in Australia that requires employers to report various aspects of their payroll, including salaries, wages, and superannuation, to the Australian Taxation Office (ATO) each time they pay their employees. This system was introduced by the federal government to enhance efficiency in reporting and ensure that information on employment and taxation conditions is shared seamlessly between employers and government agencies.

With STP, employers use STP-enabled payroll software to transmit payroll information directly to the ATO. This includes details such as amounts withheld, super guarantee liabilities, and other relevant employee records. The goal is to reduce the reporting burden on businesses and create a more transparent and timely flow of information.

What is Single Touch Payroll Phase 2?

STP Phase 2 is an expansion of the Single Touch Payroll system. It commenced on 1 January 2022. In this phase, more detailed information is reported to the ATO each time you run your payroll. This includes details of the remuneration you pay, the type of income for the employee (such as salary and wages, or working holiday maker income), and the components which make up the amounts (such as gross pay, paid leave, allowances or overtime). The ATO is working with Digital Service Providers (DSPs) to update their solutions to support Phase 2 reporting.

The progression of Single Touch Payroll into Phase 2

The progression of Single Touch Payroll into Phase 2 was announced in the 2019–20 Federal Budget. The aim is to streamline government reporting obligations and support the administration of the social security system. This expansion reduces the reporting burden for employers who need to report information about their employees to multiple government agencies. It also provides greater visibility to the types and amounts of income to which different treatments apply. This helps Services Australia’s customers, who may be your employees, get the right payment at the right time.

According to the Australian Taxation Office (ATO), there are numerous advantages for both employers and employees associated with this next phase.

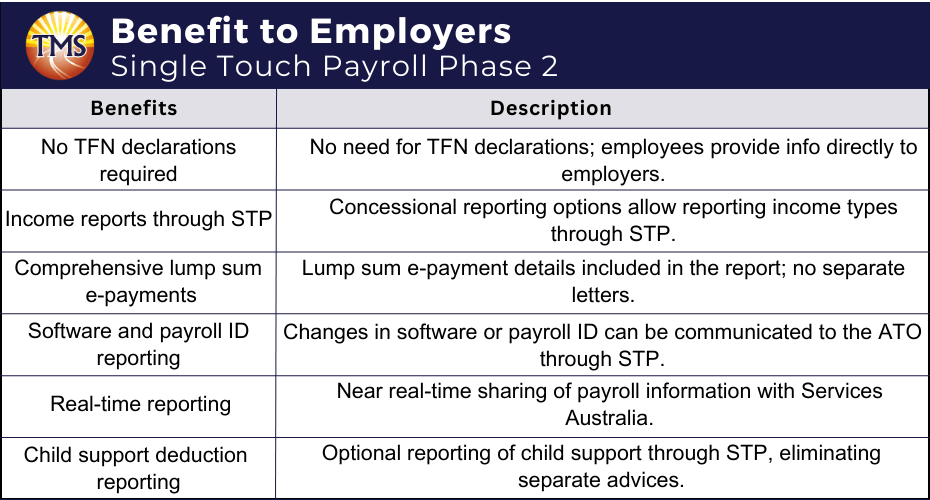

Benefits for employers:

- Employers won’t have to send Tax File Number (TFN) declarations for their employees. Instead, employees will provide this information to their employers, who will keep it in their records.

- For employers using concessional reporting options (e.g., closely held payees or inbound assignees), they can report income types through STP.

- When making lump sum E payments, employers no longer need to provide separate letters to employees. The report will now include the amount and relevant period.

- If employers change their software or an employee’s payroll ID, they can inform the ATO through the STP report, helping resolve issues with duplicate income statements.

- Payroll information reported to the ATO will be shared in near real-time with Services Australia. This will facilitate streamlined requests for employment and payroll information, reducing the need for employers to provide separation certificates.

- Employers can choose to report child support deductions or garnishees (or both) through STP, eliminating the need for separate remittance advices to the Child Support Registrar.

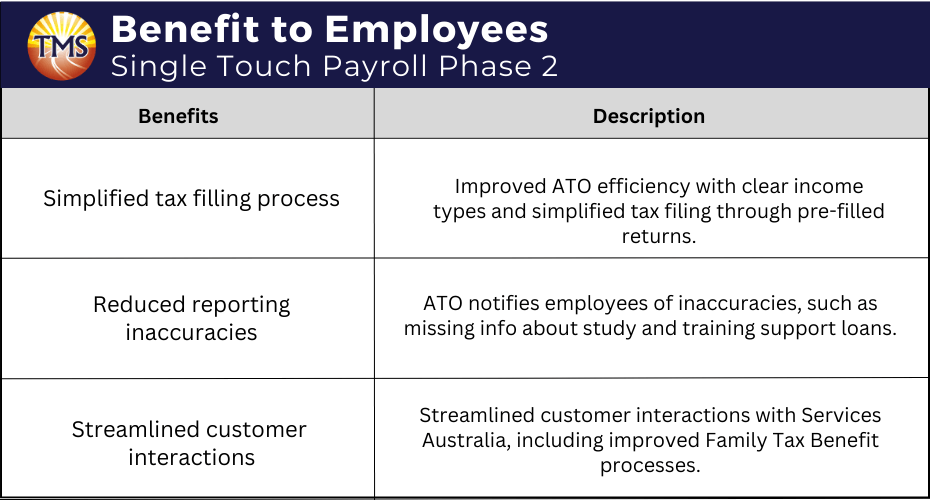

Benefits to employees

Phase 2 introduces modifications designed to enhance the Australian Taxation Office’s (ATO) efficiency in dealing with employee interactions. These changes include:

- Improved clarity on income types received, simplifying the tax filing process for employees by facilitating pre-filled individual income tax returns.

- The newly reported information allows the ATO to notify employees about any inaccuracies that may result in a tax bill over time. For example, if an employee fails to communicate information about their study and training support loan to their employer.

- Sharing STP information with Services Australia aims to streamline customer interactions. Over time, this data will enhance service delivery by pre-filling known details, minimising the need for frequent customer contact, and simplifying claims through reduced documentation requirements. Moreover, Family Tax Benefit processes will be refined with the implementation of SMS and email notifications to customers regarding low family income estimates or job-related changes. STP information will also play a role in ensuring accurate payment amounts for customers and assisting Services Australia in managing customer debt by leveraging employment and income history data for effective repayment strategies.

What are the primary changes introduced in STP Phase 2?

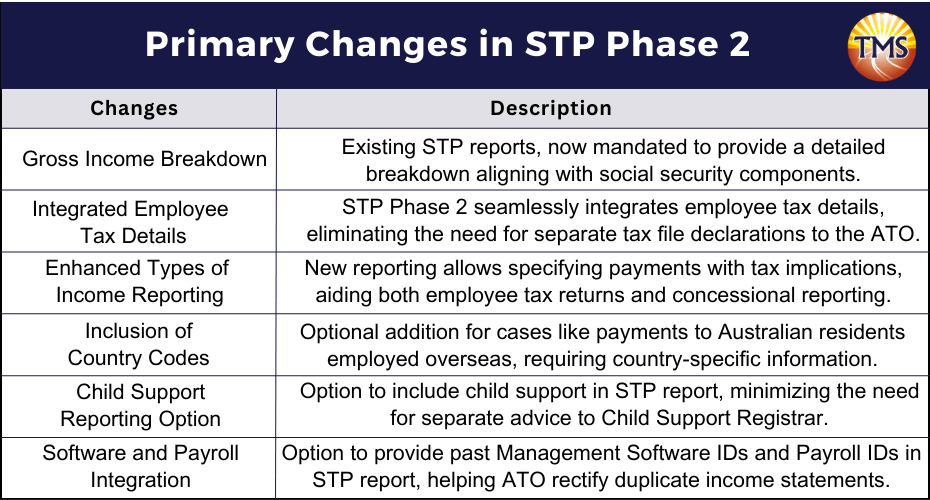

Most of the additional information necessary for the STP report is expected to be pre-existing in your current payroll software.The key adjustments to the STP report includes:

Breakdown of Gross Income

Your existing STP report presents a consolidated sum that encompasses various components and payment categories. However, to align with distinct treatments of specific components for social security purposes, a more detailed report is now mandated.

Employee Terms and Taxation Criteria

In the payroll management of your employees, numerous factors, including their employment basis, Tax File Number declaration details, and reasons for departure, come into consideration. Presently, you furnish this information in diverse formats and through various forms.

Nonetheless, Phase 2 streamlines this procedure by consolidating the information into your STP report. In Single Touch Payroll Phase 2 (STP Phase 2), employee tax details will be seamlessly integrated through STP reporting, obviating the need to submit tax file declarations separately to the Australian Taxation Office (ATO).

Types of Income

Your current STP report details the nature of income received by your employees. With the incorporation of income types reporting in Single Touch Payroll Phase 2 (STP Phase 2), you gain the ability to specify payments to your employees with specific tax implications. This not only enhances the ease of completing individual income tax returns for your employees but also aids the Australian Taxation Office (ATO) in discerning instances where concessional reporting arrangements are in use.

Country Codes

Occasionally, it might be essential to incorporate a country code in your report. This situation could arise, for instance, when disbursing payments to an Australian resident employed overseas, necessitating the provision of information regarding the host country.

Child Support

You will have the option to incorporate child support garnishees and deductions in your STP report. This choice alleviates the need for presenting separate remittance advices to the Child Support Registrar.

It’s crucial to acknowledge that this feature is discretionary, and not all STP-enabled solutions will offer this functionality.

Business Management Software and Payroll

You may be granted the option to furnish the Australian Taxation Office (ATO) with your previous Business Management Software IDs and Payroll IDs within your STP report, particularly if there have been alterations in your business structure or software, making it challenging to finalise or zero out previous records.

By supplying this information, the Australian Taxation Office (ATO) can rectify any duplicate income statements for your employees in ATO online services, thereby reducing errors.

It’s important to emphasise that not all STP-enabled solutions will include this feature, and its inclusion is discretionary.

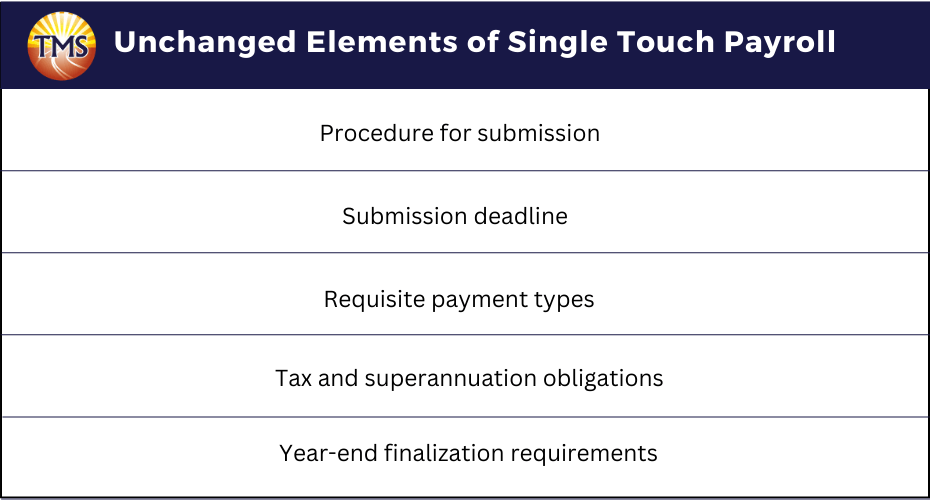

What remains unchanged?

Despite the incorporation of additional details in your STP report, several elements will persist without modification, including:

- The procedure for submission

- The submission deadline

- The requisite payment types

- Tax and superannuation obligations

- Year-end finalisation requirements

STP Phase 2 start date

Employers are required to commence Single Touch Payroll Phase 2 reporting by 01 January 2022. However, those who require additional time to gather the requisite data for Phase 2 can seek approval for an extension.

As per the Australian Taxation Office (ATO), penalties will not be imposed for genuine errors in your initial year of STP Phase 2 reporting.

Are there additional reporting requirements?

Yes, there are additional reporting obligations involving work types and the detailed breakdown of gross incomes, along with the inclusion of country codes.

Is STP compliance mandatory for my business?

Yes, the adoption of Single Touch Payroll (STP) is obligatory for companies withholding PAYG contributions from their employees. Phase 2 of STP is also mandatory. However, freelancers without employees are exempt from this requirement.

How will these adjustments affect businesses?

This adjustment will necessitate a minor initial modification to the payroll system for all employers. The extent of additional reporting will be contingent on factors such as business size, structure, employee types, and existing systems in place.

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

NEED EXPERT GUIDANCE ON SINGLE TOUCH PAYROLL?

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.