How to lower small business CGT concessions when selling an active business asset

.

If you plan to sell your small business, it’s essential to understand the small business CGT concessions available to you. These concessions can help reduce, defer, or even eliminate the Capital Gains Tax (CGT) you might face after the sale.

Several small business tax concessions could apply, including the small business retirement exemption, the 50% active asset reduction, and the small business rollover, depending on your circumstances. Understanding how these options work, along with meeting the eligibility criteria, can make a significant difference in the outcome of your business sale.

How do small business CGT concessions work?

Small business CGT concessions offer tax relief for eligible business owners when selling active assets, excluding personal and depreciating assets. These concessions help reduce the capital gain from the sale, lowering your Capital Gains Tax (CGT) obligations.

What are the available CGT concessions when selling your business?

Eligible small business owners can use several small business CGT concessions to reduce, defer, or disregard part or all of the capital gain from selling an active business asset.

The four main CGT concessions include:

-

15-year exemption

-

50% active asset reduction

-

Retirement exemption

-

Small business rollover

To qualify, certain conditions must be met at the time of the CGT event, such as selling or disposing of an active asset. Additional conditions may apply based on the specific concession and the unique circumstances of the business.

When applying concessions, the process is:

-

Apply small business CGT concessions

-

Subtract capital losses from the current or prior year

-

Apply the CGT discount, if applicable

Multiple concessions and the CGT discount may be used together if all conditions are satisfied. Contact us today for tailored advice on making the most of these concessions.

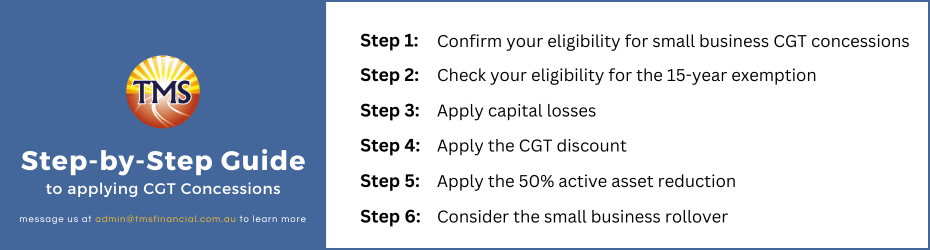

Step-by-step guide to applying small business CGT concessions

Step 1: Confirm your eligibility for small business CGT concessions

Begin by reviewing the basic conditions to determine if your business qualifies for small business CGT concessions. This includes assessing whether your business meets the small business entity requirements and whether the assets owned are considered active assets. If eligible, move to Step 2. If not, you may still qualify for the CGT discount.

Step 2: Check your eligibility for the 15-year exemption

If you meet the conditions for the 15-year exemption, you can disregard the entire capital gain. This eliminates the need for any further concessions. If you don’t qualify, proceed to Step 3.

Step 3: Apply capital losses

Offset any capital losses against your capital gains. If you have multiple capital gains, you can choose the order in which to apply the losses. If no losses are available or applicable, continue to Step 4.

Step 4: Apply the CGT discount

If you’re eligible, apply the CGT discount to reduce any remaining capital gain after offsetting your capital losses.

Step 5: Apply the 50% active asset reduction

If applicable, reduce the remaining capital gain further by applying the 50% active asset reduction. You may also choose to skip this step if you prefer to use the small business retirement exemption or small business rollover.

Step 6: Consider the retirement exemption or small business rollover

If eligible, apply the small business retirement exemption or the small business rollover to reduce any remaining capital gain. The remaining capital gain after these steps becomes the net capital gain, which is included in your assessable income for the current income year.

How to maximise your CGT concessions to lower your tax

Small business CGT concessions can significantly reduce or even eliminate the capital gain from selling business assets. If you qualify, you can apply multiple concessions, potentially reducing your capital gain to zero.

Small business 15-year exemption

If your business has owned the asset for at least 15 consecutive years, and you are 55 or older and retiring, or permanently incapacitated, the entire capital gain from the sale will be exempt from your assessable income.

Small business 50% active asset reduction

If you’ve owned an active asset for at least 12 months, you can reduce the capital gain by 50%, further lowering your tax liability.

Small business retirement exemption

You can exempt up to $500,000 of capital gain over your lifetime when selling a business asset. If you are under 55, the exempt amount must be contributed to a complying superannuation fund or retirement savings account.

Small business rollover

This allows you to defer part or all of the capital gain for up to two years or longer, as long as you acquire a replacement asset or make capital improvements to an existing asset. The gain will remain deferred until another CGT event occurs.

By applying these CGT concessions, you can reduce your taxable capital gain and lower your overall tax. For tailored advice on which concessions apply to your business, contact us today for a consultation.

How to use CGT exemptions to boost your super

Small business owners can take advantage of certain CGT concessions to make significant contributions to their superannuation without affecting their non-concessional contributions cap. By using the 15-year exemption or the retirement exemption, you can enhance your retirement savings while also reducing your Capital Gains Tax liability.

Small business 15-year exemption

If you qualify for the small business 15-year exemption, you can contribute the exempt amount from the sale of a business asset directly to your superannuation fund. These contributions do not count towards your non-concessional contributions cap, allowing you to increase your retirement savings without impacting your other super contributions.

Small business retirement exemption

Similarly, amounts received through the small business retirement exemption can also be contributed to your superannuation fund. Like the 15-year exemption, these contributions will not affect your non-concessional contributions limits, giving you another opportunity to grow your retirement savings while reducing your capital gain from selling a business asset.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Book a Consultation

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

How high-income earners can boost their super through salary sacrifice

How high-income earners can boost their super...

Using the downsizer super contribution: A guide for homeowners over 55

Using the downsizer super contribution: A guide...

How high-income earners can benefit from voluntary super contributions

How high-income earners can benefit from...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.