Maximise your savings with energy-efficient assets using the small business energy incentive

.

Are you struggling with high energy bills for your small business?

With the small business energy incentive, you can get a significant tax deduction for investing in energy-efficient assets. This includes upgrading to efficient heating and cooling systems, installing solar panels, or adopting other renewable energy sources. By taking these steps, you can reduce energy consumption and save on operational costs.

Contact us now to discover how the small business energy incentive can help you lower your energy bills and improve efficiency.

What is the small business energy incentive?

Are you looking to cut down on energy costs and boost efficiency in your business? The small business energy incentive is designed to help businesses like yours achieve these goals.

If your business has an aggregated annual turnover of less than $50 million, you can qualify for a bonus 20% tax deduction on the cost of eligible assets and energy efficiency improvements improvements. This incentive supports investments in energy-efficient equipment and upgrades, allowing your business to save money and operate more sustainably.

Contact us to find out how your business can benefit from the small business energy incentive by using the link here.

How does the small business energy incentive work?

The energy incentive covers eligible expenditure on assets and improvements made between 1 July 2023 and 30 June 2024, known as the ‘bonus period’.

This includes expenditures on improvements to existing assets during this time. Businesses can claim up to $100,000 of total expenditure under this incentive, with a maximum bonus tax deduction of $20,000.

The bonus deduction is separate from and in addition to other deductions typically claimed under tax law. This initiative helps businesses enhance their energy efficiency while reducing their tax liabilities.

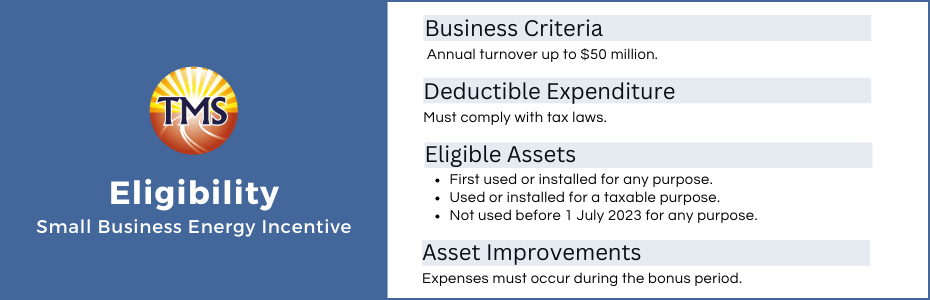

Eligibility for the small business energy incentive

To qualify for the small business energy incentive, your business must meet these criteria:

- Have an aggregated annual turnover of less than $50 million.

- Ensure the expenditure is deductible under existing tax provisions.

For new assets during the bonus period, the asset must be:

- First used or installed ready for use for any purpose.

- Used or installed ready for a taxable purpose.

If an asset is first used or installed before 1 July 2023, it’s not eligible for the bonus deduction, even if it was used for a taxable purpose during the bonus period.

For improvements to existing assets, the expenditure must occur during the bonus period.

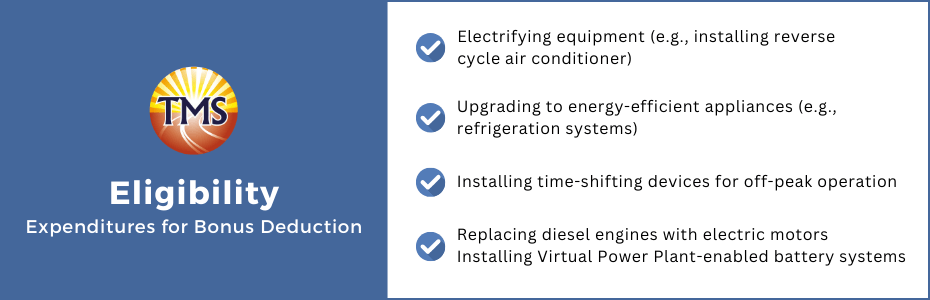

What can you claim on the energy incentives?

Eligible expenditures

You can claim a bonus deduction for expenditures on the following:

- Electrifying equipment, such as installing a reverse cycle air conditioner instead of a gas heater.

- Upgrading to more energy-efficient appliances and equipment, like energy-efficient refrigeration systems.

- Installing time-shifting devices that allow electrical appliances to operate during off-peak times.

- Replacing a diesel engine with an electric motor.

- Installing a Virtual Power Plant-enabled battery system.

If the expenditure is partly for private purposes, the bonus deduction is calculated based on the business-related portion of that expenditure.

If your business is registered for GST and the expenditure is not GST-free, the bonus deduction is calculated on the amount of expenditure less the GST amount claimable as an input tax credit.

Depreciating assets and the small business energy incentive

The small business energy incentive offers a bonus deduction for expenditures on depreciating assets that meet specific criteria:

-

The asset must be first used or installed ready for use between 1 July 2023 and 30 June 2024.

-

The asset must be installed and ready for use for a taxable purpose during this period.

A depreciating asset qualifies for the bonus deduction if it uses electricity and fits one of the following conditions:

-

A new comparable asset using fossil fuels is available in the market.

-

The asset is more energy efficient than the one it replaces.

-

If not a replacement, it is more energy efficient than a new comparable asset available in the market.

“Available in the market” means the comparable asset could be readily purchased either locally or online at the same time.

Additionally, a depreciating asset can be eligible if it functions as energy storage, time-shifting, or monitoring device, or if it enhances the energy efficiency of another asset. The asset can be second-hand, provided the comparable asset is available as new in the market.

Why does the energy incentive exist?

The small business energy incentive aims to assist small and medium businesses in cutting down their energy expenses and improving efficiency. By investing in items like solar panels, energy-efficient refrigerators, heat pumps, and hybrid or electric vehicles, businesses can enhance their energy savings. This incentive supports both the acquisition of new assets and the upgrade of existing ones, encouraging the use of renewable energy and promoting sustainability.

Supported by the Australian government, this initiative helps small businesses transition to smarter energy use, contributing to a robust economy through efficient energy consumption and clean electricity generation.

List of expenditures you cannot claim

You cannot claim the bonus deduction for the following expenditures:

-

Assets and expenditures on assets that primarily use fossil fuels, except for minor uses like oil-based lubricants.

-

Assets and expenditures on assets intended mainly for electricity generation, such as solar panels.

-

Capital works projects.

-

Motor vehicles, including hybrid and electric vehicles, and any related expenditures.

-

Expenditures assigned to software development pools.

-

Financing costs, such as interest and borrowing expenses.

Additionally, if a balancing adjustment event occurs during the bonus period, you cannot claim the bonus deduction unless the asset is lost or destroyed through an involuntary disposal.

When can you claim the deduction?

You can claim expenses in the income year they are incurred. For depreciating assets first used or installed and ready for use during the bonus period, claim the bonus deduction in the same income year they become operational and are used for a taxable purpose. For improvements to existing assets, claim the bonus deduction in the income year when the expenditure occurs.

If your business has a substituted accounting period, you can spread the bonus deduction across multiple income years, provided the asset was first used or installed, or the improvement costs were incurred, during the bonus period. The maximum bonus deduction available through the energy incentive is $20,000.

When spreading the deduction over several income years, any amount claimed in a previous year reduces the maximum amount you can claim in subsequent years. This ensures the $20,000 cap on bonus deductions is consistently applied, regardless of whether your business uses a standard or substituted accounting period.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Book a Consultation

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.