Maximise Your Tax Savings and Grow Your Wealth with Strategic Tax Planning

.

Are you looking to optimise your financial outcomes, reduce tax liabilities, and accelerate wealth growth? With the financial year-end approaching, now is the perfect time to take proactive steps towards effective tax planning.

At TMS Financial, we specialise in strategic tax planning and can guide you through the complex tax landscape to maximise your benefits. In this comprehensive article, we will highlight various tax planning strategies and scenarios that can help you achieve significant tax savings and build your wealth.

Key Priorities for 2023: A Comprehensive Tax Planning Approach

Reviewing Trust Distributions:

Maximising Superannuation Fund Contributions

Superannuation funds serve as a powerful tool for retirement savings, and it’s essential to maximise your contributions to enjoy substantial tax benefits. In the financial year 2024/25, the concessional contribution cap stands at $30,000 per year, covering all before-tax contributions, including employer contributions, salary sacrifice, and personal contributions that you claim as a tax deduction.

Additionally, for high-income earners, it’s crucial to be aware of the maximum super contribution base (MSCB) set by the government. For the 2024/25 financial year, the MSCB is $65,070 per quarter. This means your employer is required to make Superannuation Guarantee (SG) contributions of 11.5% on earnings up to this cap each quarter. Earnings above this limit do not require SG contributions, which is important to consider when planning your superannuation strategy.

By taking advantage of the concessional contribution cap, you can optimise your superannuation strategy and reap the rewards in the long run. Consider the following steps to make the most of your superannuation contributions:

-

Assess carry-forward amounts: Evaluate any carry-forward amounts from previous years that you may have available. These amounts can be added to your current year’s contribution cap, allowing you to make larger contributions and maximise your tax benefits.

-

Employer super payments: Ensure that you’re making the most of employer super payments by actively engaging with your employer and exploring opportunities for salary sacrifice. By diverting a portion of your pre-tax salary into your superannuation fund, you not only reduce your taxable income but also contribute more towards your retirement savings.

-

Personal contributions: Take advantage of the ability to make personal contributions to your superannuation fund and claim them as a tax deduction. This allows you to further reduce your taxable income while increasing your superannuation balance.

By strategically maximising your superannuation contributions within the concessional contribution cap and understanding the implications of the MSCB, you can strengthen your retirement savings and benefit from the concessional tax rate applicable within the superannuation fund system. It’s crucial to consult with a qualified financial advisor or tax professional who can guide you through the specifics of your individual circumstances and ensure compliance with the regulations surrounding superannuation contributions.

Bringing Forward Deductible Expenses

Deferring Taxable Income

Managing Capital Gains

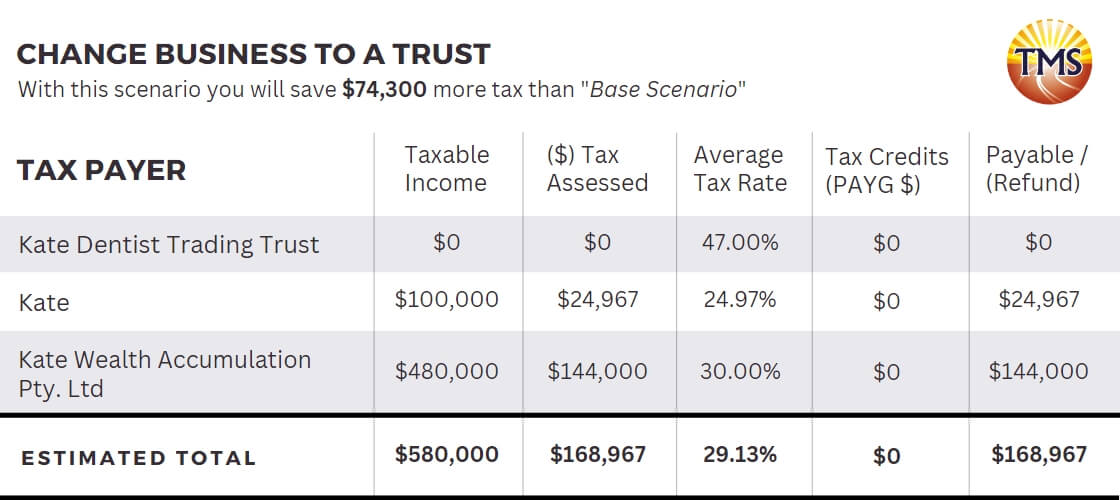

Using a Family Trust or “Bucket Company”

A Family Trust or “bucket company” structure can offer valuable tax benefits. Depending on your circumstances, this structure can help cap your tax liability at either 25% or 30%. By distributing income to beneficiaries in a tax-effective manner, you can achieve significant tax savings while ensuring asset protection and flexibility in financial management.

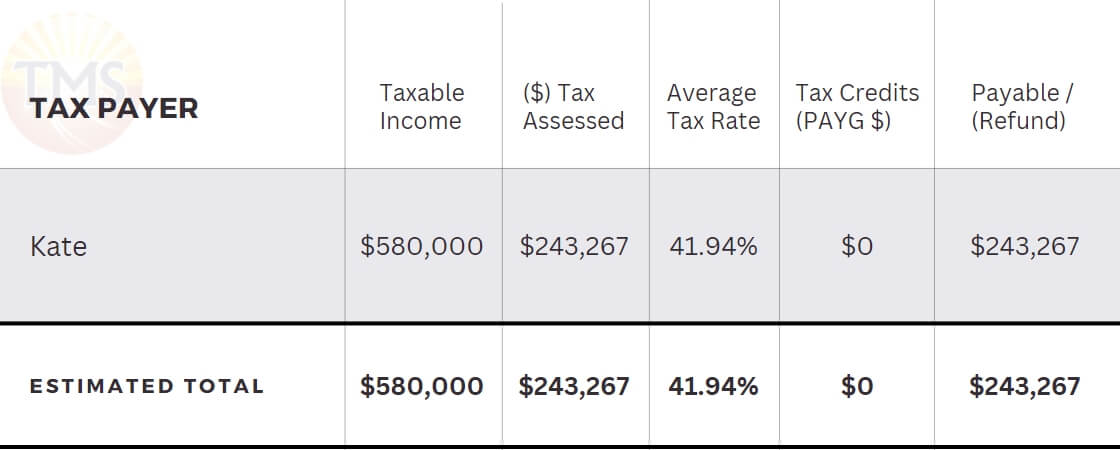

Case Study: Tax Planning Strategies for Dentist Kate

Scenario 1: Utilising a Family Trust and Bucket Company to Cap Tax at 30%

Distribution to Kate: $100,000

Distribution to Corporate Beneficiary: $480,000

By restructuring her business as a Family Trust and establishing a corporate beneficiary, Kate reduced her tax liability from $243,267 to $168,967. This restructuring resulted in substantial tax savings of $74,300, allowing her to retain more of her hard-earned income. Additionally, the new structure provided asset protection and enhanced financial flexibility.

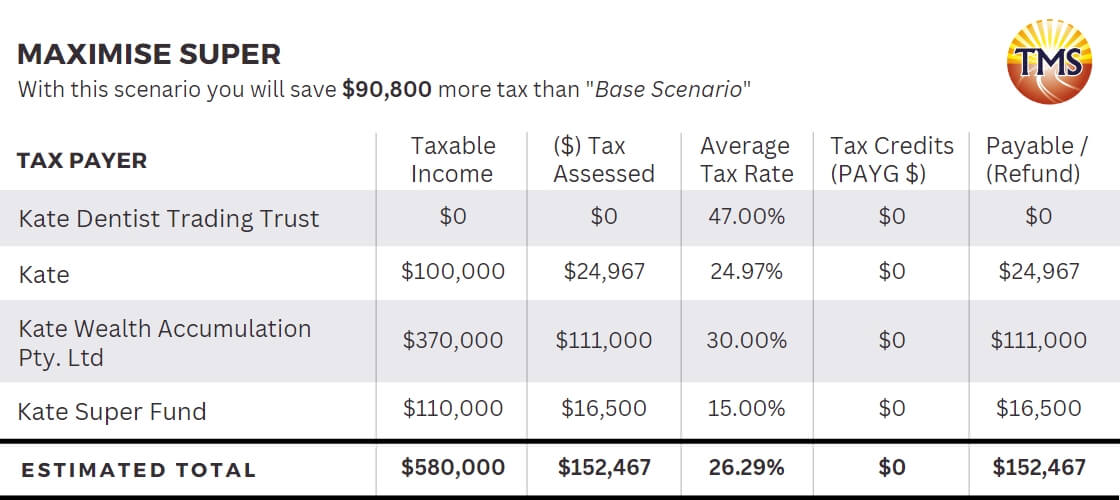

Scenario 2: Maximising Superannuation Contributions

Having successfully optimized her tax position using the Family Trust and Bucket Company structure, Kate decided to focus on her retirement savings. She desired control, investment choice, and flexibility over her superannuation funds, leading to the following tax planning strategy:

Kate’s self-managed super fund (SMSF) had a total superannuation balance of $280,000.

Carried forward unused concessional contributions cap as of 30 June 2023: $110,000.

Kate decided to make a personal super contribution of $110,000 to her SMSF, utilising the Carring forward unused concessional contributions cap.

Tax Outcome:

Kate’s taxable income remained at $100,000, resulting in a tax liability of $24,967.

The corporate beneficiary, Kate Wealth Accumulation Pty Ltd, received a distribution of $370,000, leading to a tax liability of $111,000 (at a 30% tax rate).

The super fund contribution of $110,000 was subject to a concessional tax rate of 15%, resulting in a tax payable of $16,500.

Total Tax Liability:

The combined tax liability for Kate’s personal income, corporate beneficiary distribution, and super fund contribution amounted to $152,467

Tax Saving:

By leveraging the carried forward unused concessional contributions cap, she made a personal super contribution of $110,000 to her self-managed super fund (SMSF). This strategic move not only secured her retirement future but also resulted in significant tax savings. In total, Kate saved $90,800 compared to her original structure through this tax planning strategy.

Summary

Scenario 2: Maximising Superannuation Contributions: Consider the story of Kate’s journey to maximise her superannuation contributions. By leveraging the carried forward unused concessional contributions cap, Kate was able to make a personal super contribution of $110,000 to her self-managed super fund. This strategic move not only secured her retirement future but also resulted in significant tax savings, reducing her tax bill from original $243,267 to $152,467, total tax saving of $90,800.

Scenario 2: Maximising Superannuation Contributions: Consider the story of Kate’s journey to maximise her superannuation contributions. By leveraging the carried forward unused concessional contributions cap, Kate was able to make a personal super contribution of $110,000 to her self-managed super fund. This strategic move not only secured her retirement future but also resulted in significant tax savings, reducing her tax bill from original $243,267 to $152,467, total tax saving of $90,800.

Case Study Disclaimer

Imagine the Possibilities:

By implementing strategic tax planning strategies, you have the opportunity to unlock a world of possibilities. The tax savings you achieve can be utilised in various ways, allowing you to shape your financial future according to your aspirations and dreams. Consider these exciting possibilities that can become a reality with the tax you save:

- Reduce your home loan and become mortgage-free sooner, providing financial security and peace of mind.

- Boost your superannuation and enjoy a more comfortable retirement, ensuring a financially stable future.

- Save for your dream holiday or travel the world, creating cherished memories and enriching experiences.

- Create a deposit for an investment property and build a property portfolio, expanding your wealth through real estate.

- Invest in your children’s education and provide them with a bright future, empowering them to reach their full potential.

- Upgrade your car or indulge in other personal luxuries, enhancing your lifestyle and enjoying the rewards of your hard work.

Conclusion

Through tax planning, individuals and businesses can take advantage of tax deductions, tax credits, and other tax concessions to lower their tax liabilities. This can free up funds that can be redirected towards other financial goals, such as reducing debt, boosting savings, investing in assets, or improving cash flow.

Furthermore, strategic tax planning empowers individuals to have more control over their financial affairs. By carefully managing their tax obligations, taxpayers can allocate resources in a manner that aligns with their long-term objectives. They can make informed decisions about retirement planning, investment choices, and overall wealth accumulation.

In conclusion, effective tax planning is a proactive and ongoing process that enables individuals and businesses to take advantage of various tax planning strategies, deductions, and concessions. By harnessing the power of tax planning and seeking professional advice, taxpayers can minimise their tax liabilities, optimise their financial outcomes, and create a solid foundation for long-term wealth growth. Don’t delay! Take action now and leverage the benefits of strategic tax planning to secure your financial future.

Next Steps:

Get Professional Advice from TMS Financials

Disclaimer

Do you want to optimise your financial outcomes

AND REDUCE TAX LIABILITIES

Contact Us and Let’s Get Started!

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.