Navigating the Super Guarantee Charge: A Comprehensive Guide for Employers

.

Understanding and fulfilling your obligations related to the employee’s super guarantee is vital as an employer. To avoid any extra fees, such as the administration fee or nominal interest for late payment, you must pay the super guarantee charge to the employee’s super fund in a timely and accurate manner.

To avoid costly unintentional errors, it’s crucial to have a thorough understanding of the Super Guarantee Charge (SGC) Statement. This document offers comprehensive details about the super guarantee payments made within a quarterly period, ensuring the appropriate amounts have been transferred to the eligible employees’ super funds.

To guarantee you meet all superannuation obligations, consider using resources such as the ATO’s online services, which includes a statement and calculator tool. These tools assist in determining the correct Super Guarantee Charge amount and in avoiding potential issues like contributing to the wrong super fund or legal action due to unpaid SGC debts. By possessing adequate knowledge and making prudent use of these tools, you can ensure timely super guarantee payments and successfully navigate the world of super contributions without any difficulties.

What is the Super Guarantee Charge (SGC)?

The Super Guarantee Charge, commonly known as SGC, is a mandatory contribution that employers must make to their employees’ superannuation funds. It’s calculated as a specific percentage of the employees’ regular earnings and forms a vital part of their total remuneration. Currently, the SGC rate is at 11%, with a planned increase to 12% by July 2025. These mandatory contributions are essential in ensuring the financial security of employees when they retire.

What happens if SGC obligations are ignored?

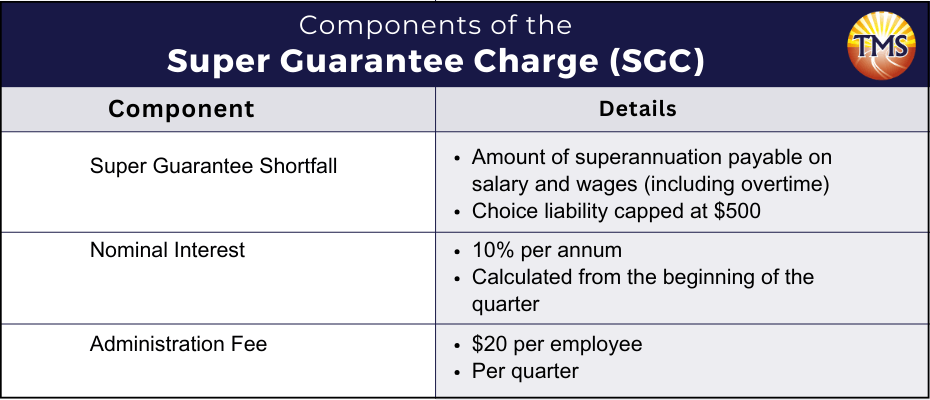

Ignoring the obligations of the Super Guarantee Charge (SGC) can bring about serious repercussions for businesses. Neglecting to make these essential payments can lead to substantial financial fines. The penalty for not adhering to SGC commitments includes charges for the super guarantee shortfall, additional nominal interest, and an administration fee for each employee every quarter. In certain circumstances, penalties can escalate up to 200%.

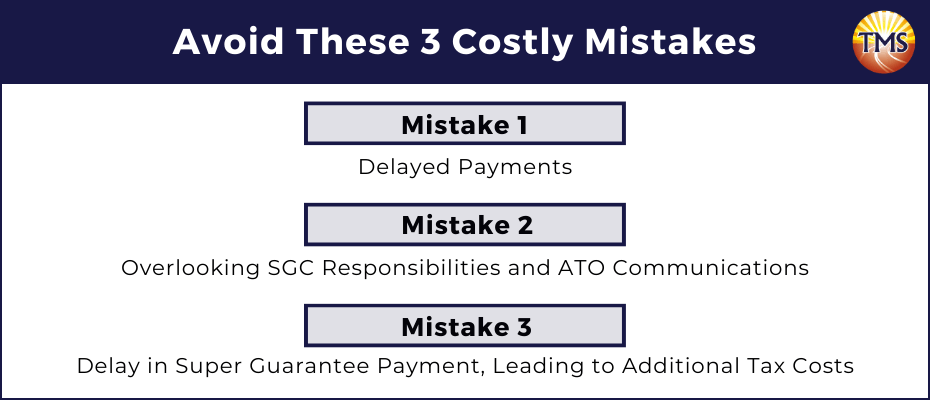

Mistake 1: delayed payments

A significant error employers can make is not adhering to the quarterly due dates for Super Guarantee Charge (SGC) payments. Overlooking these deadlines can set off a cascade of financial repercussions, underscoring the importance of maintaining a consistent payment schedule.

Knowing the SGC deadlines

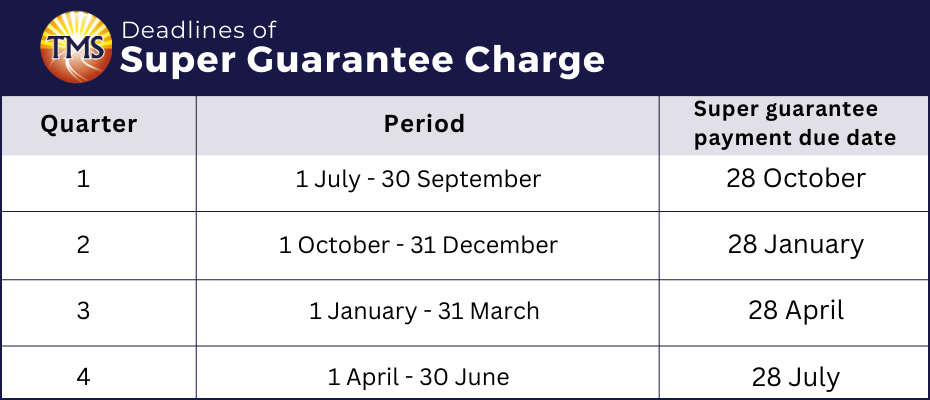

To avoid delays in payments, it’s essential for business proprietors to be familiar with the primary deadlines for Super Guarantee Charge (SGC) contributions:

Quarter 1: 1 July – 30 September (Deadline: 28 October)

Quarter 2: 1 October – 31 December (Deadline: 28 January)

Quarter 3: 1 January – 31 March (Deadline: 28 April)

Quarter 4: 1 April – 30 June (Deadline: 28 July)

If a deadline happens to coincide with a weekend or a public holiday, ensure the payment reaches the fund by the subsequent working day.

How to prevent delayed super guarantee payments

To avoid the repercussions of missing deadlines and incurring penalties, consider employing the following approaches:

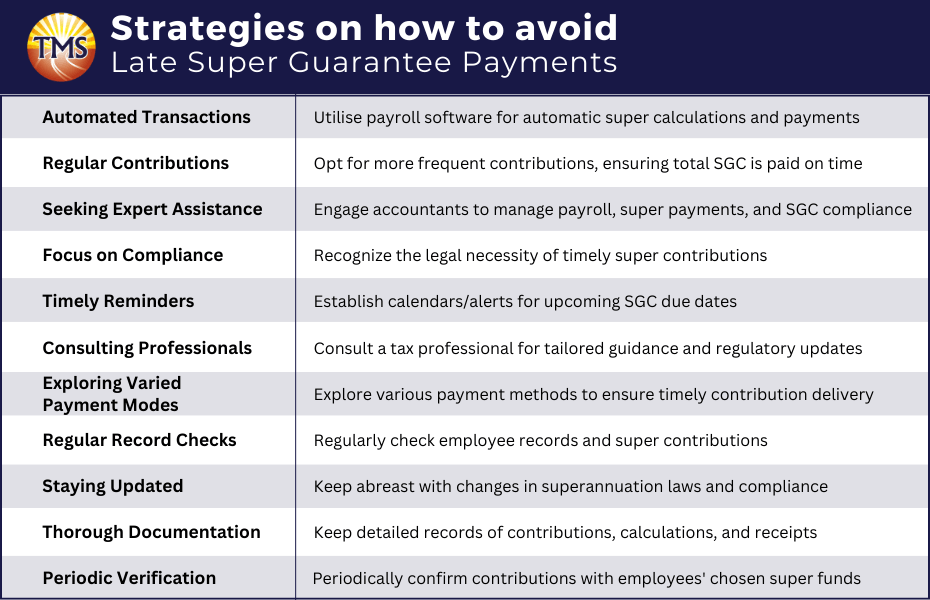

Automated Transactions

Use payroll software to automatically calculate and make super payments. This method not only saves time but also minimises the possibility of mistakes.

Regular Contributions

Even though quarterly contributions are mandatory, think about making more frequent payments (such as fortnightly or monthly) to ensure the total SGC contribution for the quarter is paid by the deadline.

Seeking Expert Assistance

If handling super payments proves to be a daunting task, do not hesitate to get help from an accountant. They can manage payroll duties, super payments, and guarantee adherence to SGC rules.

Focus on Compliance

Recognise the legal obligation to pay super contributions and its significant impact on both employee relationships and your business’s financial well-being.

Timely Reminders

Establish calendars or alerts to remind you about the approaching SGC due dates, enhancing organisation and averting late payments.

Consulting Professionals

Engage with a tax expert specialising in superannuation for individualised advice and updates on regulations.

Exploring Varied Payment Modes

Think about employing diverse payment methods to assure timely contributions to your employees’ super funds. Certain funds might offer various payment options, including direct transfers or digital platforms.

Regular Record Checks

Continuously scrutinize employee records and super contributions to identify and rectify issues swiftly.

Staying Updated

Continuously update yourself regarding alterations in superannuation regulations and compliance prerequisites.

Thorough Documentation

Keep comprehensive records of super contributions, computations, and payment receipts to present as proof of compliance during audits or disagreements.

Periodic Verification

Occasionally check contributions with the super funds chosen by employees for accurate accounting.

By adopting these strategies and keeping informed about SGC deadlines and payment methods, you can markedly diminish the risk of encountering SGC-related complications. This proactive stance not only shields you from penalties but also imp employee relations and assures your business’s financial solidity.

Mistake 2: overlooking SGC responsibilities and ATO communications

A frequent error some business proprietors make is neglecting their superannuation duties, either because of financial constraints, oversight, time pressures, or a deliberate choice to sidestep these commitments. However, it’s paramount to understand that any delays or negligence can have grave implications.

This can tarnish the credibility of your business and erode the confidence your employees place in you. If Superannuation Guarantee Charge (SGC) duties aren’t fulfilled, workers might bring this to the attention of the Australian Taxation Office (ATO). In such cases, the ATO will typically dispatch compliance reminders. Ignoring these reminders might lead the ATO to intensify their approach.

Such escalation could mean the ATO launching an investigation into your enterprise. If they gather enough evidence, they might hand out an assessment notice. This could lead to hefty fines, possibly amounting to 200% of the unpaid superannuation sums. As a result, it’s essential to address these obligations swiftly to ward off potential negative outcomes.

Case study example: Jeff and Mary’s retail business

Jeff and Mary run a retail business, employing 12 individuals. To their dismay, they neglected their obligations regarding the employees’ superannuation guarantee payments. This oversight led to receiving a letter from the Australian Taxation Office (ATO) urging action:

“Ensure to lodge your Super Guarantee Charge (SGC) statements by the specified due date. Immediate action is essential to prevent further penalties.”

Regrettably, Jeff and Mary dismissed the urgency of this ATO notification and failed to respond. Consequently, the ATO presented them with a bill of $330,000. This sum comprised the Superannuation Guarantee Charge, an administration fee, nominal interest, a super guarantee shortfall for the pertinent financial quarters, and an added penalty equating to 200% of the SG Charge.

The entire situation could have been avoided had they promptly lodged their SGC statements and settled the super guarantee charge when due. This instance serves as a stark reminder of the severe repercussions of neglecting employer responsibilities, which can culminate in hefty financial penalties, late payment offset choices, and potential legal action.

Jeff and Mary are currently in search of personal financial guidance to address their Super Guarantee Charge (SGC) liability. They are contemplating the option of proposing a payment plan to settle the remaining super balance. It’s imperative for businesses to stay informed about their SG obligations, accurately compute their super guarantee payments using tools like the SGC calculator, and keep updated contact information for all impacted employees in order to steer clear of costly errors of this nature.

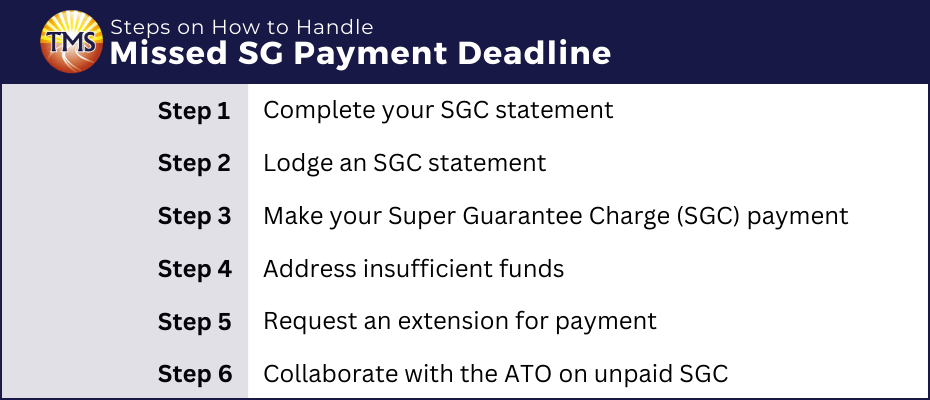

How should employers respond if they don’t meet the SG payment deadline for their workers?

If you’ve inadvertently missed the due date for Super Guarantee payments to your employees, it’s imperative to act without delay. Here’s a recommended course of action:

Step 1: prepare your SGC statement

In the face of a payment oversight, initiating the Super Guarantee Charge (SGC) statement should be your immediate priority. Here are some steps:

Method 1: SGC Calculation Tool

Leverage the SGC calculator, available on business or individual online services platforms.

This tool simplifies the determination of your obligations and eases the submission process.

Method 2: Manual entry with the SGC statement spreadsheet

Opt for the SGC statement spreadsheet found in Online services for business or Online services for individuals if you prefer hands-on data input.

Method 3: Traditional PDF and postal method

Use the SGC statement and calculator tool to produce a PDF variant of your record. It’s worth noting that this method, though available, is less favored due to a higher likelihood of mistakes and extended processing intervals. For guidance on this SGC Calculator, follow this link.

Step 2: Submit an SGC statement

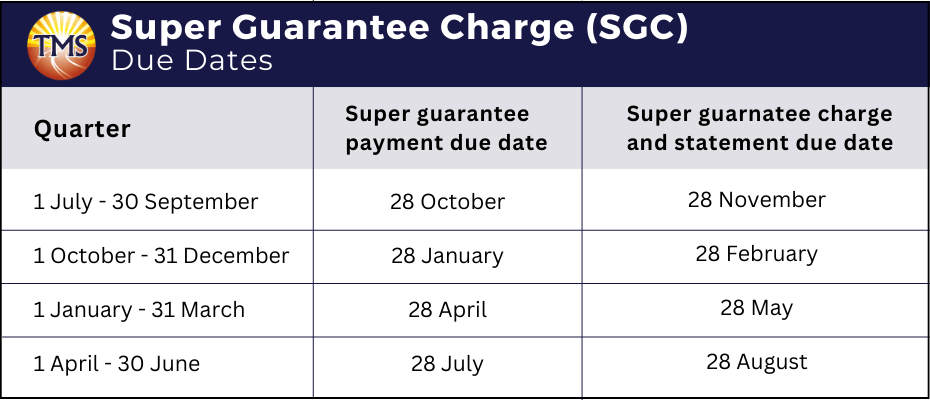

To prevent further penalties, it’s crucial to lodge your Super Guarantee Charge statements by the key due dates:

- Quarter 1 (1 July – 30 September): payment due by 28 November

- Quarter 2 (1 October – 31 December): payment due by 28 February

- Quarter 3 (1 January – 31 March): payment due by 28 May

- Quarter 4 (1 April – 30 June): payment due by 28 August

Late Super Payment Offset

In case you’ve made a late contribution to an employee’s fund prior to the SGC assessment being issued, you have the opportunity to request a late payment offset election. This request must be made within four years from the initial SGC assessment to counterbalance the late super payments. Authorisation from the ATO is mandatory for this process to proceed.

Step 3: settle your Super Guarantee Charge (SGC) dues

When addressing your SGC responsibilities:

- Secure a Payment Reference Number (PRN) using the Online services for business or Online services for individuals. This PRN is a requirement for completing your SGC transaction.

Step 4: tackle insufficient fund issues

If you’re short on funds to cover the complete SGC amount:

- Ensure you lodge your SGC statement punctually, illustrating your intent to fulfill your obligations.

- Connect with the ATO to discuss possible assistance or installment plans to pay the SGC in phases.

Step 5: seek a payment extension

If you need an extension to settle your SGC:

- Submit a request for a deferred payment to the ATO. This lets you postpone your payment without accumulating extra penalties. Be aware, however, that the General Interest Charge (GIC) will be applied to this delayed payment until the entire SGC amount is cleared.

Step 6: partner with the ATO concerning unpaid SGC

It’s vital to understand how the ATO deals with unresolved SGC debts:

- The ATO regards unsettled SGC responsibilities gravely and prioritises recovery measures.

- It’s beneficial to collaborate actively with the ATO to promptly manage any dues. Neglecting or avoiding the situation could lead to more stringent measures and enhanced penalties from the ATO.

By adhering to these structured guidelines and actively liaising with the ATO, you can efficiently handle any lapses in SGC payments and ensure you remain in line with superannuation standards.

Mistake 3: delay in super guarantee payment, leading to additional tax costs

Besides the initial two frequent errors concerning super guarantee contributions, entrepreneurs should be mindful of the significant tax consequences tied to delayed payments.

When super guarantee payments are not made on time, the Australian Taxation Office (ATO) labels them as overdue, initiating a variety of repercussions. Such late contributions are not considered tax-deductible, meaning they cannot be deducted from your taxable income. For a contribution to be tax-deductible, it should be fully paid and acknowledged by the employee’s super fund before the due date.

For instance, if a business has a super guarantee shortfall of $50,000 for its employees and it’s consistently paid late, these payments won’t qualify for a tax deduction . In a company structure, this late payment can lead to an extra 25% tax on the $50,000, which equates to an unnecessary payment of $12,500 in taxes.

Emphasising the timely payment of your Super Guarantee is crucial. It’s an easy way to lessen your tax burden. Delaying payments not only denies you the opportunity to claim a tax deduction but also incurs additional financial charges.

Here’s what you might face due to delayed super guarantee payments:

- Nominal interest, administration fee, and penalties: the ATO can apply interest and penalties on overdue SG payments, amplifying your financial load.

- Personal liability: ignoring your superannuation obligations could make you personally liable for the debts, risking your personal assets.

To counteract the adverse outcomes of delayed payments, it’s vital to implement solid systems to make sure your SG contributions are persistently on time. Nevertheless, if you cannot meet these obligations, it’s vital to address the issue right away. Lodge a Superannuation Guarantee Charge (SGC) statement to inform the ATO about your situation and avoid including these late amounts in your business tax return if you’ve crossed the deadlines.

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Concerned about meeting Super Guarantee Charge deadlines?

Book a free consultation with TMS Financials today and get the clarity you need

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.