With our expertise in accounting and taxation, we navigate complex tax laws and maximise your financial outcomes. We offer services that cover income tax, Capital Gains Tax (CGT), and Goods and Services Tax (GST), alongside preparing financial statements and business activity statements. Whether you’re a sole trader, a small business owner, or an investor, TMS Financials is committed to helping you secure the best possible results in all your financial endeavours.

Why choose TMS Financials?

We celebrate 30 years of trusted service

With over 30 years in the industry, TMS Financials is known for its reliability and exceptional service. We are committed to offering accurate financial advice and asset protection, maintaining honesty, professionalism, and quality in all we do.

We are consistently reliable

You can rely on us for prompt responses and proactive management of your tax and financial matters. We ensure your finances are up-to-date and in line with the latest tax laws.

We uphold unwavering integrity

Trust and integrity are central to our approach at TMS Financials. We manage your financial affairs with the utmost care, ensuring you can trust us completely.

We offer experienced advice

Benefit from our three decades of experience across various industries. We provide personalised advice tailored to your specific needs and circumstances, guiding you through your financial journey with expertise.

Partner with TMS Financials

We’re an Australian tax accounting firm with 30+ years of experience serving business owners and investors. Our reputation for reliability and exceptional client service is built on providing accurate financial advice and asset protection. We remain committed to serving our clients with integrity, professionalism, and quality, and have the expertise to help you succeed.

TMS Financials is online now

Our Credentials

TMS Financials is a proud member of the following

Eng Sivieng

Principal of TMS Financials

We strive to build long-term relationships with our clients and to be a trusted advisor for all their financial needs.

Tax Services

Partnership Tax Returns

Partnerships simplify the business management process by allowing partners to share profits and losses directly. We support partnerships in maintaining straightforward tax lodgements, avoiding the rigidity of corporate compliance.

Sole Trader Tax Services

Operating with an Australian Business Number (ABN), sole traders need to lodge individual tax returns where business income is taxed at personal rates. Our services include detailed support for sole traders, ensuring all business income is correctly reported and taxed.

Company Tax Returns

For those operating as a company, the process involves complex filings due to the separate legal entity status. We provide guidance on navigating the intricacies of company tax returns, helping you leverage the benefits of a corporate structure.

Trust Tax Return Support

Trusts offer flexibility for asset protection and wealth distribution, but require careful tax planning as beneficiaries are taxed on received income. We assist with trust formation, including drafting and executing Trust Deeds, ensuring compliance and strategic tax management.

Investment Property Tax Returns

At TMS Financials, we specialise in handling individual tax returns, ensuring you benefit from all possible deductions and credits. As a Registered Tax Agent, we can extend your lodgement deadline and facilitate payment plans, ensuring compliance with the Australian Taxation Office (ATO) and simplifying your tax season.

SMSF Tax Returns

Strategic Tax Planning and Asset Protection Services

Tax Planning Expertise

Effective tax planning is crucial for enhancing the financial health and peace of mind of our clients. Our deep understanding of Australian Taxation Office (ATO) regulations allows us to implement tax-efficient structures and strategies, focusing on maximising deductions and using every available exemption and concession. This includes often overlooked areas such as personal superannuation contributions. Our tailored approach caters to the unique circumstances of each client, delivering consistent results for individuals, sole traders, family-owned businesses, small to medium enterprises, and larger companies.

Using Bucket Companies for Tax Efficiency

Maintaining profitability is a key responsibility for any business owner, especially when business profits start to increase. Planning ahead for tax obligations is essential to avoid surprises. While maximising deductions is a common strategy, relying solely on deductions might reduce your profit unnecessarily. Understanding the most tax-effective ways to distribute income is critical. Integrating a bucket company into your tax planning could optimise how profits are managed and taxed, supporting the financial stability of your business and family.

Asset Protection and Business Structuring

Our services extend to protecting your assets and structuring your business to safeguard your financial future. We offer strategies that are customised to your specific needs, including establishing trusts, risk management assessments, estate planning, and succession planning. Our goal is to ensure your assets are protected and your business structure aligns with your long-term financial objectives.

Comprehensive Accounting Services for Your Business

Bookkeeping That Aligns with Your Business Needs

Our bookkeeping team acts as an integral part of your operation, providing more than just accounting services—we partner with you to ensure the financial health of your business. We prepare critical financial statements such as profit and loss statements, balance sheets, and cash flow statements, which detail your operating expenses, asset and liability balances, and cash movements. Additionally, our team delivers real-time financial reports that are clear and easy to understand, enabling you to make informed business decisions promptly. We are always available to support and guide you.

Company Setup and Compliance

Deciding on the best structure for your new business can be challenging. We offer expert advice on choosing the most suitable entity structure tailored to your specific circumstances. Our services extend beyond advice; we assist with the entire setup process, ensuring ongoing compliance and management of corporate accounting and tax returns. Our comprehensive setup assistance includes incorporation of companies, corporate compliance, and registrations needed for smooth operations, such as Tax File Numbers (TFN), Australian Business Numbers (ABNs), GST, PAYG Withholding, and Fringe Benefits Tax (FBT).

Corporate Secretarial Services

As the Australian Securities and Investments Commission (ASIC) enforces strict regulations on company conduct, compliance is crucial for any director. We can serve as your ASIC Registered Agent, handling corporate secretarial duties on your behalf. Our services include appointing an ASIC agent, modifying share structures, changing company names, and updating details of officeholders and members. We also assist with ASIC voluntary deregistration, ensuring that every aspect of your corporate governance is in line with regulatory requirements.

Expert Advisory Services

Business Advisory Services

At TMS Financials, we’re committed to being a part of your business success story. Our business advisory services have helped a wide range of clients—from small to medium-sized enterprises to family-owned businesses and well-established retail companies throughout Australia. Whether you’re looking to increase profitability, expand your customer base, or prepare your business for sale, our team offers core business advisory services tailored to your specific needs. We provide strategic advice to help you overcome challenges related to business growth, work-life balance, or enhancing cash flow and profitability. Our experience and dedication are reflected in the success of our clients and our passion for seeing them thrive in business and in life.

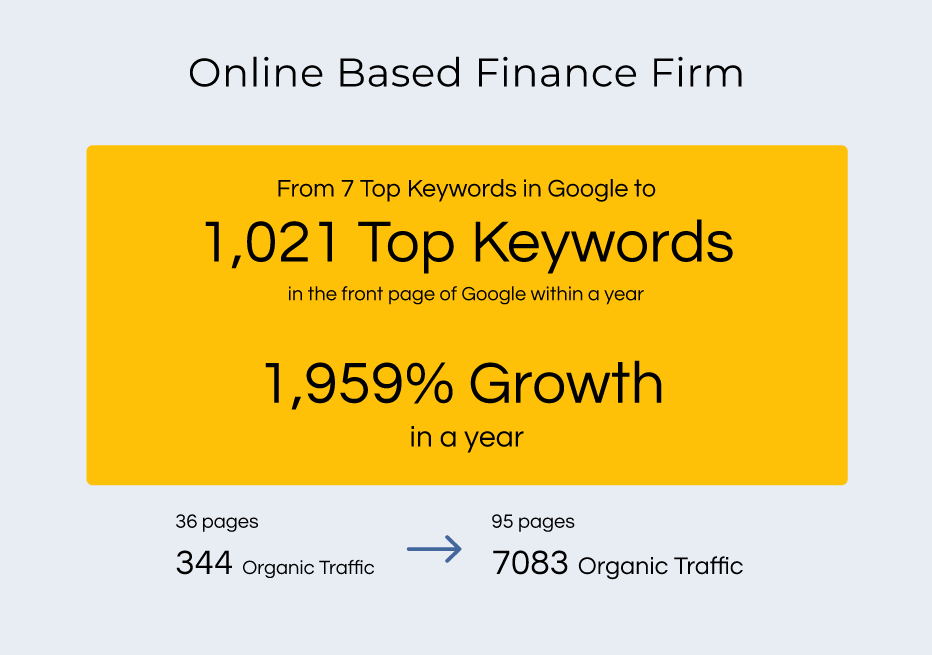

Digital Marketing Solutions

Our digital marketing services are designed to help you build and execute effective marketing strategies across various digital channels, including Search Engine Optimisation (SEO), direct email marketing, and social media marketing. We work exclusively with a select group of clients, allowing us to offer bespoke solutions that are finely tuned to the unique aspects of their business and market. This approach ensures that we can dedicate the necessary time to deliver quality, precision, and superior outcomes, fostering a partnership that values and achieves excellence in every facet of your digital presence.

Disclaimer

Contact us today for a consultation.

Contact us today to learn more about how our accounting services can benefit your business. We look forward to hearing from you and helping you achieve financial success!