Understanding your status as an Australian resident for tax purposes

.

If you’re planning on entering Australia or if you’re an Australian resident who is planning to travel abroad, you might need to freshen up on the recent updates from the ATO around tax residency. The new framework impacts withholding tax provisions, and also has repercussions for other areas such as Capital Gains Tax (CGT), the Medicare levy, and Commonwealth Government employees stationed at Australian posts overseas.

If you’re an overseas student enrolled in an Australian institution, understanding your residency status for tax purposes is important, as it determines how you are taxed on your worldwide income. Generally, Australian residents are taxed on their global income, while foreign residents are taxed only on Australian-sourced income.

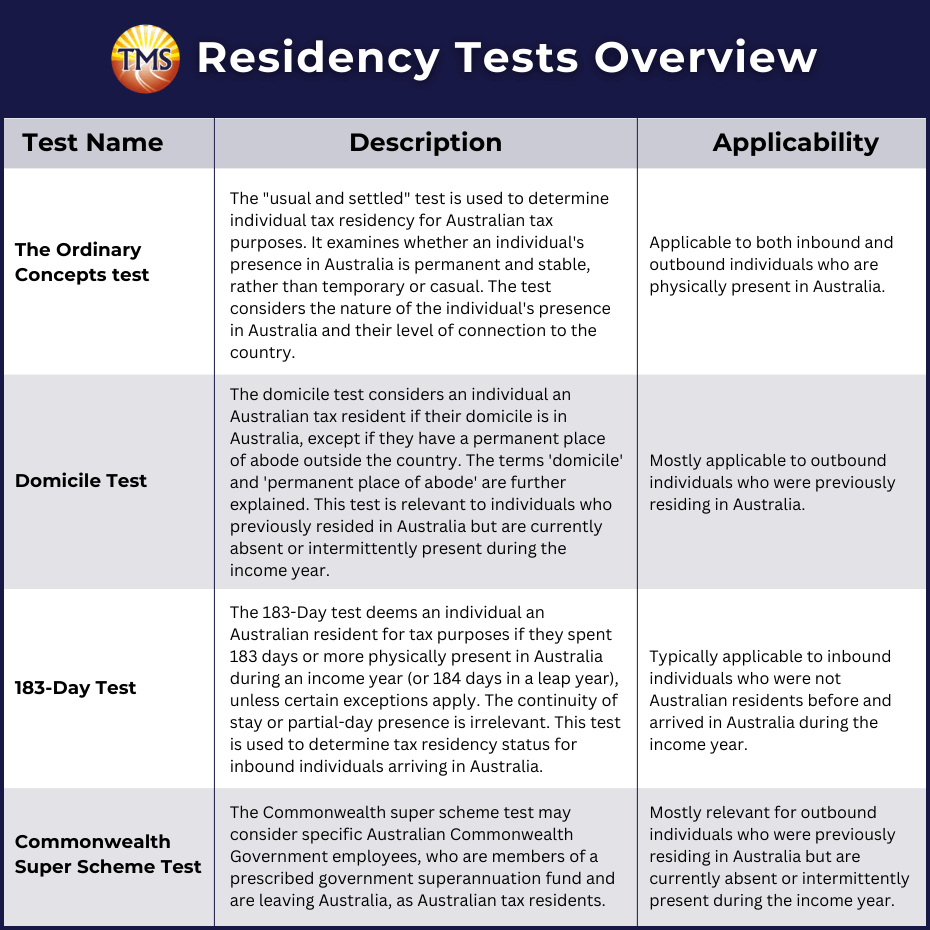

Understanding the four tests for determining tax residency in Australia

Your tax residency status in Australia is primarily based on the definition of ‘resident’, which employs four distinct tests to make that determination. If you meet the criteria of any one of these tests, you’ll be regarded as a tax resident in Australia. If none of the tests apply to you, you’ll be considered a non-resident for Australian tax purposes.

Here’s a detailed explanation of these four critical tests:

The Ordinary Concepts Test

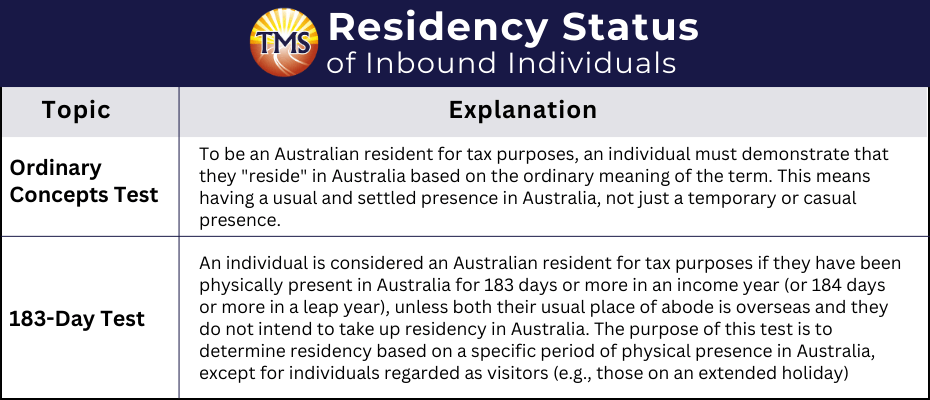

The principal method for determining individual tax residency in Australia uses the “ordinary concepts” criterion. This checks if an individual’s stay in Australia is of a lasting, established nature rather than a fleeting one. It evaluates the depth of the individual’s ties and duration of stay in the country. This method applies when you’re in Australia and caters to both people entering and leaving the nation.

The Domicile Test

In this context, having an Australian domicile does not necessarily make you an Australian tax resident if you have an established residence elsewhere. The specific definitions of terms such as ‘domicile’ and ‘permanent place of abode’ will be covered later. This test is particularly relevant if you have previously resided in Australia but are not currently living in the country, or are present only intermittently during the income year. Essentially, this test is most applicable if you’re departing Australia.

The 183-Day test

According to this test, you qualify as an Australian tax resident if you’re physically present in the country for a minimum of 183 days within a regular income year, or 184 days if it’s a leap year. However, exceptions can be made by the ATO if:

- Your usual place of residence is situated outside of Australia, and

- You have no plans to establish a permanent residence in Australia.

The total number of days accounted for under this test can comprise both consecutive and intermittent periods of presence within the Australian borders during the income year. Importantly, even a partial day’s presence in Australia is counted as a full day for the purposes of this test.

This 183-day test is particularly aimed at individuals who are not previous Australian residents and have entered the country during the applicable income year—essentially catering to inbound individuals.

The Commonwealth super scheme test

This test is mainly relevant for Australian Commonwealth Government employees who are members of designated superannuation schemes, such as CSS or PSS schemes, and are departing Australia. Under this framework, these employees may continue to be recognised as Australian residents for tax-related matters.

Much like the Domicile Test, the Commonwealth Superannuation Test holds particular relevance for those who have previously resided in Australia but are either not currently in the country or are only present sporadically during the income year. This test is chiefly tailored for individuals who are exiting Australia, or in other words, outbound individuals.

By acquainting yourself with these various residency tests, including this one, you can more accurately assess your Australian tax obligations. This is crucial whether you’re an inbound individual entering Australia, an outbound individual leaving the country, or someone planning an extended stay.

Assessing the tax residency status of inbound individuals in Australia

If you’re entering Australia (inbound individuals), there are two primary benchmarks for determining your tax residency status: the Ordinary Concepts Test and the 183-Day Test. These tests act as the basis for assessing an individual’s tax responsibilities within the Australian legal framework.

Guidelines on tax residency for temporary workers in Australia

If you’re a temporary worker in Australia, it’s important to know how the country’s tax residency rules might apply to you.

Common Residency Tests

-

Ordinary Concepts Test and 183-Day Rule: Both of these tests determine if someone is considered a tax resident in Australia. However, for short-term temporary workers, these tests typically indicate they’re not tax residents.

-

Seasonal Worker Programs: Workers under the Seasonal Worker Program (SWP) or the Seasonal (Short-Stay) Pacific Australia Labour Mobility (PALM) scheme are generally not deemed tax residents. This is due to the limited duration of their stay and minimal ties to Australia.

What this means for Temporary Workers

-

Tax-Free Threshold: If you’re not considered a tax resident, you might not qualify for the tax-free threshold.

-

Withholding Tax Provisions: Your Australian-sourced income might be subject to withholding taxes.

-

Income Tax: Based on Australian Taxation Office (ATO) guidelines, earnings from work done in Australia are considered Australian-sourced income. Foreign residents typically pay tax only on this Australian income, whereas Australian residents are taxed on their worldwide income.

Tax residency guidelines for working holiday makers in Australia

For those on a working holiday in Australia, understanding tax residency status is crucial. The rules for determining tax residency, such as the ordinary concepts test and the 183-day rule, apply to working holiday makers just as they do to other taxpayers.

Working holiday makers often come to Australia for a short-term break from their usual overseas routine, anticipating a return to their home country after their stay. Their employment ties in Australia are generally casual, their living arrangements are flexible, and their overall activities mimic those of a visitor more than a permanent resident.

In many cases, working holiday makers do not qualify as Australian residents for tax purposes under the ordinary concepts test. Even if they stay for more than 183 days during the income year, their primary place of abode is usually outside Australia. Their actions and intent often reflect a temporary stay without the aim of establishing a permanent residency in the country.

Determining the residency status of outbound individuals

For individuals planning to leave Australia, commonly referred to as outbound individuals (which includes Australians relocating internationally for professional or personal reasons), tax residency is determined using two primary tests:

-

The Ordinary Concepts Test

-

The Domicile Test

Ordinary Concepts Test

When assessing if an outbound individual remains a resident under the Ordinary Concepts Test (essentially if the individual still ‘resides’ in Australia), the criteria applied remain consistent with those for inbound individuals. The aim is to determine whether the individual’s connection to Australia is consistent with being an Australian resident for tax purposes, based on ordinary concepts.

Domicile Test

The Domicile Test focuses on Australians who maintain their national identity but have shifted their tax residency due to establishing a permanent home abroad. The primary goal of this test is to exempt such individuals from Australian tax on their foreign-sourced income. This test differentiates between those settling permanently overseas and those with a transient or temporary overseas stay.

Tax-free threshold adjustment for Part-Year Residents

In situations where an individual qualifies as a tax resident based on the ordinary concepts test, the domicile test, or the 183-day test, yet only spends a portion of the income year in Australia, their tax residency doesn’t extend throughout the entire year. Instead, the initiation and cessation of residency hinges on the individual’s unique circumstances.

When an individual transitions into or out of being an Australian tax resident during an income year, the tax-free threshold (which currently stands at $18,200) typically undergoes proportional adjustment. Consequently, while the resident marginal tax rates remain consistent, the tax-free threshold’s value is altered.

To address this scenario, individuals have traditionally been required to complete “Item A2: Part-year tax-free threshold” in their individual tax returns. This enables accurate pro-rating of the tax-free threshold based on the following information:

-

The precise date when the individual either commenced or concluded their Australian tax residency.

-

The number of months within the income year for which the individual was eligible for the tax-free threshold. This involves calculating the months they were a tax resident.

This approach ensures individuals with part-year tax residency receive appropriate consideration and accurate taxation in alignment with their specific circumstances.

Understanding Double Tax Agreements (DTAs)

When someone is both an Australian tax resident and a resident of another country—dual residency—the focus shifts to Double Tax Agreements (DTAs) between Australia and that foreign nation. DTAs are designed to avoid double taxation, where the same income might be taxed by both countries.

DTAs often include ‘tie-breaker rules’ that decide which country has the primary right to tax-specific types of income for dual residents. These rules use factors like permanent abode, personal and economic ties, and usual residence to determine tax residency.

For instance, if someone qualifies as an Australian tax resident and a resident in another country, the tie-breaker rules in the DTA come into play. They clarify which country should have the main tax authority. This prevents confusion in dual residency situations, helping avoid issues like Capital Gains Tax or withholding tax problems.

If your residency status changes during the year

If you shift from being an Australian resident to a foreign resident during the income year, mark ‘yes’ for Australian residency on your tax return. This ensures resident tax rates for the year and a prorated tax-free threshold based on months of Australian residency. Foreign residents are exempt from the Medicare levy. You can indicate the days of non-residency in your return as exempt days.

After ceasing Australian residency, there’s no need to report foreign-source income. Australian-sourced interest, dividends, and royalties post-residency are subject to withholding tax as final tax, excluding them from your return.

Include Higher Education Loan Program (HELP), VET Student Loan (VSL), Trade Support Loan (TSL) debts, impacting worldwide income and repayments. Tax residency status shapes your tax rates, determined by tests such as the Domicile and Commonwealth Superannuation tests.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.