What is a Notice of Assessment?

The Australian Taxation Office requires all persons, both residents and non-residents, to file their income tax returns. The tax return summarises your income and claimable expenses during the financial year.

Before filing the tax return, be sure that your details are updated, such as bank details, address, and contact information. Lodging it on or before the due date is necessary to avoid additional fees for late filing.

In cases where you have paid your taxes in advance during the financial year, you might receive a tax refund if it’s more than your actual tax obligation. Furthermore, once you submit and lodge the tax return to the ATO, they will then issue you a notice of assessment.

What is a Notice of Assessment?

A Notice of Assessment is a document issued by the Australian Taxation Office (ATO) after processing a tax return or franking credits lodgment.

It is an important document given by the ATO since it provides a summary of your taxable income during the year and your tax position. The notice of assessment will include the following details:

- Tax payable on your taxable income

- Tax credits applied during the income year

- Tax refundable or payable amount

- Excess private health refund or reduction, if any

When do you receive a notice of assessment?

The lodgment method you chose for the tax return will determine the processing timeframes the ATO will aim for.

If you lodge:

- Through Paper Lodgment – the ATO will aim to process the assessments within 50 business days (10 weeks) after receiving them (but paper method lodgments may take up to 7 weeks to show on ATO systems)

- Using myTax Online – If you use this method, the ATO has two weeks to process your notice of assessment.

- Through a Registered Tax Agent – you should also expect to receive the notice of assessment within two weeks.

Where can I find my Notice of Assessment?

Steps to Retrieve a Notice of Assessment:

- Sign in to my.gov.au

- Click on ATO from your services.

- Click on “My Profile” found in the Menu Bar.

- In the drop-down menu, click on “Communication.”

- Click on “History”

If you misplace or lose your refund cheque, you must contact the ATO immediately for a replacement cheque. After validating your identity, you will receive the replacement cheque plus another copy of your NOA by post.

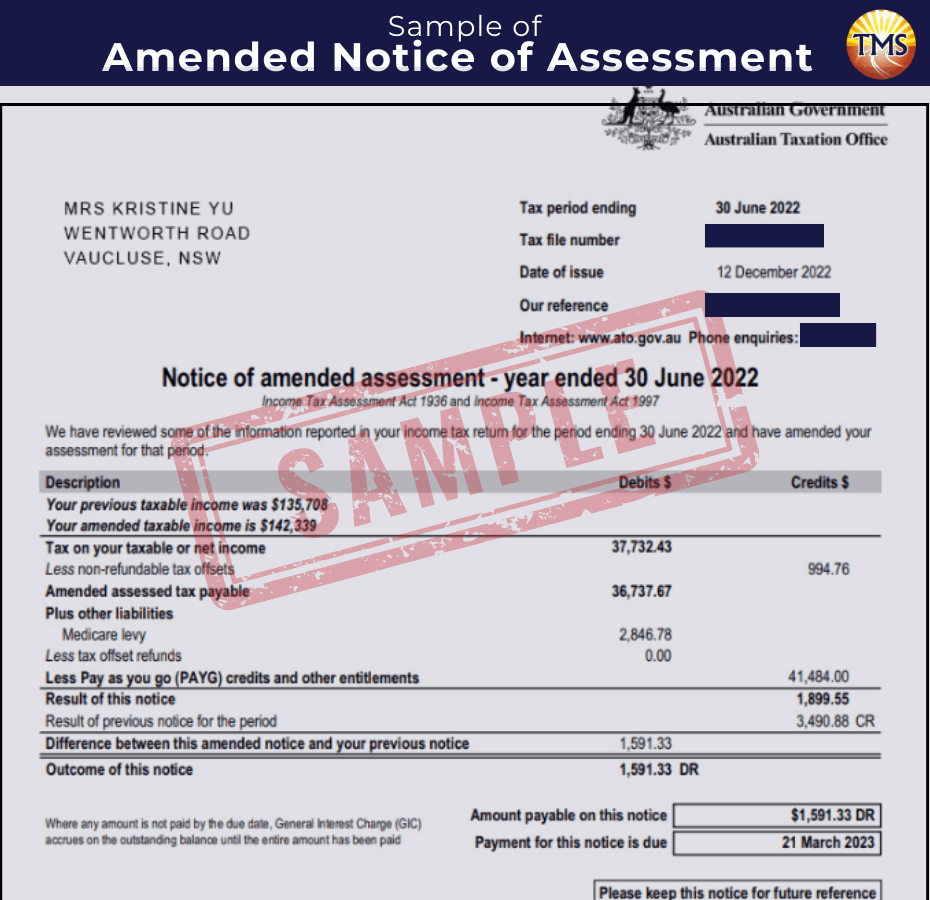

What’s an amended notice of assessment?

- When you discovered that you failed to disclose income or expenses that need to be declared on your tax return, or you made an error in completing it. You must submit an amended tax return to correct it then the ATO will issue an amended NOA.

- If the ATO conducts an audit and determines that you failed to record some income or expenses, in which case you will receive a notice of amended assessment reflecting the adjustments.

You can also connect with the ATO and request further assistance. Just be sure to have your documents ready such as your copy of your tax return and your notice of assessment for references.

Next Steps

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Have questions about your tax assessment?

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.