Published on 10 May, 2021

How to pay yourself a salary as a company director

A “bucket company” allows you to “cap” the tax on profits distributed by a trust to

30% or 27.5%. This is much less than the individual top marginal rate of 47%!

30% or 27.5%. This is much less than the individual top marginal rate of 47%!

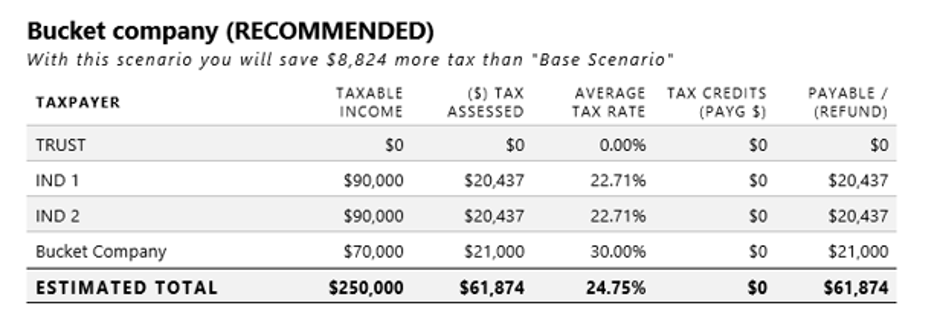

OPTION 2. Distribute $90,000 each to individuals 1 & 2 and distribute balance of $70,000 to a “bucket” company at a 30% tax rate . Total tax payable = $61,874 ( 24.75%)

Value of strategy is $8,824 in tax saved!

“Bucket”

Company

$70,000 Income from Trust

taxed at lower rates of

30% or 27.5%

Future franked dividends

go to Shareholders

go to Shareholders

Uses Cash to:

- Invest in shares, properties and loan funds to other companies

- Should never operate a business or engage in risky activities.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.